Product teams, including those I work with, struggle to connect the challenges observed in prior research to issues that endure in the field and market space. As a shortcut for efficiency gains, product partners...

Product teams, including those I work with, struggle to connect the challenges observed in prior research to issues that endure in the field and market space. As a shortcut for efficiency gains, product partners...

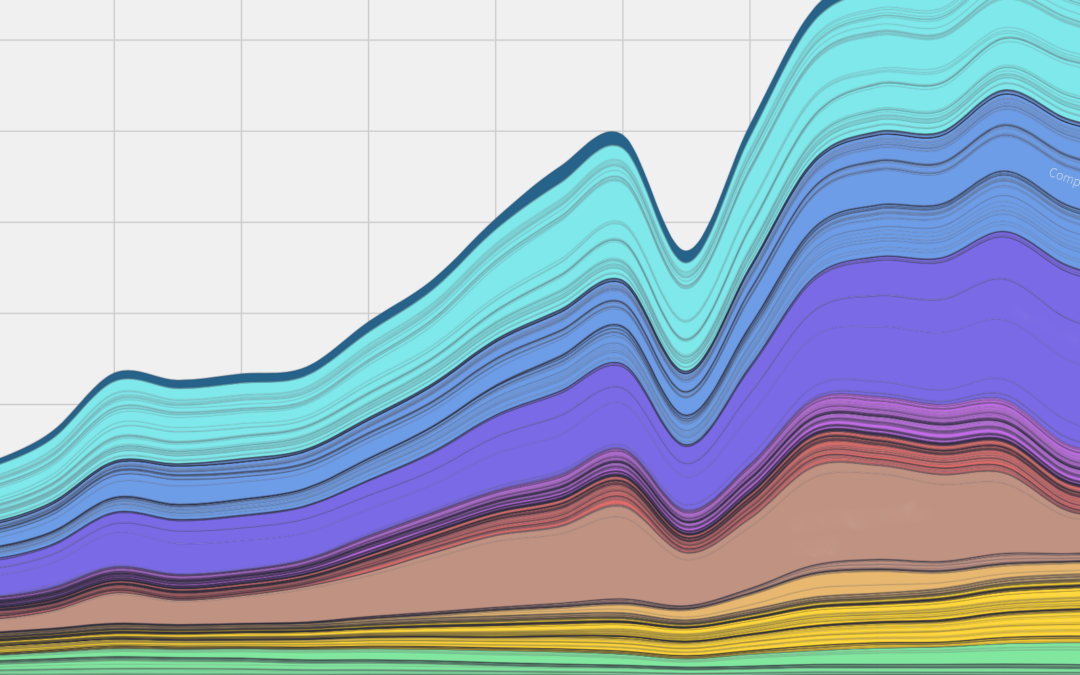

Evidence produced within quantitative disciplines like economics and finance carries an aura of gospel. The numbers, models, and forecasts we see in economic reports and market analyses in the news and reports seem certain, authoritative, and unarguable. Built on large data sets that are analyzed...