Apparel & footwear (A&F) give us social identity, protection and a means of self-expression. But in a pandemic these ways of thinking about clothing are essentially pointless. When the world shuts down and stays at home, how are A&F companies supposed to figure out what’s next – and how to gear themselves up for the future?

At TRIPTK, we created the What’s Next Desk, a ‘what do we do about it next’ set of strategic and tactical actions for a global leader in apparel & footwear to respond to the behavioral shifts in consumer trends during COVID-19.

We believe ethnographic research is a powerful approach for connecting companies to the people, communities and culture they serve. And when the world shuts down and we’re forced to throw the classic ethnographic playbook out the window, we still believe the ethnographic approach is possible and preferred.

We believe that at its core, ethnography promotes empathy, contextual understanding and a cultural sensitivity that helps business be a force for good. To catalyze the adoption of approaches from anthropology, sociology and the social sciences more broadly, commercial practitioners must prove out the impact of ethnographic research to the corporate bottom line.

In this case study, we have furthered that endeavor in threefold ways: Making a global business resilient to the dramatic impact of COVID-19, developing a methodology set and tool kit that is resilient to change and developing strategy that is resilient to subjectivity.

Keywords: business, resilience, marketing, innovation, strategy, global, footwear & apparel, branding

INTRODUCTION

A global leader in apparel & footwear (A&F), US-headquartered VF Corp is home to some of the world’s most popular outdoor, action sports and streetwear brands including The North Face, Vans, Dickies, Timberland and Supreme. With more than a thousand storefronts worldwide, the publicly listed company employs 50,000 people and reports a revenue of USD 13.8 billion.

Moving at the speed of fashion culture is essential in A&F: it allows brands to stay abreast of consumer needs and to navigate a highly competitive arena. In a category where cultural change is so fast-paced, COVID-19 pressed the pause button, turning human tragedy into anonymous statistics overnight and reducing the reaction time of brands and businesses to zero as stores were shuttered and supply chains came to a grinding halt.

In summer 2020, this meant that acute insight needs were emerging which required a leap beyond ethnography’s reliance on traditional, first-hand consumer experiences. VF Corp brands still needed to stay relevant and nurture authentic consumer connections; their innovation teams still needed to ensure real consumer pain points were addressed; and their strategy folks still had to lay plans.

This case study illustrates how VF Corp partnered with TRIPTK, a global brand transformation studio, to overcome the constraints and uncertainties brought about by the global pandemic, charting a course from business decline to stable growth.

The case addresses resilience in 3 ways:

- Developing a methodology set and tool kit that is resilient to change

- Developing strategy that is resilient to subjectivity

- Making a global business resilient to the dramatic impact of COVID-19

DEVELOPING A METHODOLOGY SET AND TOOLKIT THAT IS RESILIENT TO CHANGE

A ‘mission-impossible’ project scope

In the first year of the pandemic, TRIPTK was tasked with helping VF Corp to adapt the global business strategy of its entire brand portfolio (especially Vans, The North Face, Dickies and Timberland) to help them maintain revenue and quickly respond to future trends. VF needed answers to the following questions:

Table 1. Key areas of investigation included in VF’s overall project scope

| Ingoing areas of investigation: due to COVID-19… | New Value: How is the overall value proposition in A&F changing? | Health & Wellness: How are H&W trends impacting our brands and the worlds they come from? | Localization: Will there be a shift in consumer preference towards local / national A&F brands? |

These are big, expansive questions – and in an ideal world, ethnography is the perfect way to answer them – especially when major tectonic shifts occur in culture everywhere, all at once, and with an outsized impact on categories like footwear and apparel.

Classical ethnography is ideal because:

- It unpacks real consumer behaviors, as well as the rituals and narratives in their communities that cue moments of cultural change [Sleck, 2013];

- It unlocks market context insights: instead of ending at each consumer household’s front door, it places consumer actions in the context of market trends and dynamics [Taylor, 2017];

- It applies foresight methods to anticipate change by learning from people’s real-life, daily journeys of anticipation and improvisation [Allen, 2021]

But in summer 2020, when in-person interactions were unthinkable and culture was evolving at warp speed, this was impossible – for the reasons outlined in table 2 below.

Table 2. Key reasons why an ideal-world ethnographic approach would have been unthinkable, and what TRIPTK’s methodological approach had to solve for

| We would have wanted to… | We couldn’t do this because… | So we needed a methodology that could help us unpack: |

|---|---|---|

| Unpack real consumer behaviors by investigating each brand community in depth and comparing them to one another: Vans users, vs. The North Face users, vs. Dickies users, vs. Timberland users | It wasn’t safeEven if it had been safe, it would have been cost prohibitive to run robust research with ~25 households per brand (=100 households) | Culture & Social influence, across key VF brands |

| Unlock market context insights by conducting research in top VF markets: Europe, APAC and North America – and by contrasting what we were learning about VF brands with key competitor insights | It wasn’t safeEven if it had been safe, it would have been even more cost prohibitive: ~25 households per brand x 4 brands x 1-2 markets per region (=300-600 households) | Context surrounding consumers, wherever they live and shop |

| Apply foresight by investigating apparel & footwear needs, attitudes and behaviors over time – what were they like before COVID-19? What changed and why? How are weekdays different to weekends; work and free time occasions? | We only had 12 weeksUsing traditional ethnography to immerse with 300-600 households would have taken at least half a year | Change affecting consumers over time, and informing VF business operations in the next 6-18 months |

When you can’t be an ethnographer, think like one

Building the What’s Next Desk: A new methodology rooted in ethnographic theory

Our methodology couldn’t just shift from offline to online ethnography, or focus on just one market, or just synthesize future trend reports – it had to tackle everything, everywhere, all at once.

With all that in mind, TRIPTK developed a plan to chart VF Corp’s path toward business resilience.

Turning constraints into opportunities, TRIPTK built a methodology designed to shift from reactive response to scenario-based foresight through the establishment of an innovative ‘What’s Next Desk’, which had to replace and complement full-fledged ethnographic immersion. The desk needed the following components:

- An insight phase to help us assemble the right data

- A strategy phase to help us interpret the data and chart a go-forward plan

We’ll start with the insight component in this section, then display the strategy component in the next one. The insight component needed to be at least on par with the quality of insight we’d expect from an ideal-world, ethnographic process – and the strategy component had to deliver foresight, 6–18 months into the future.

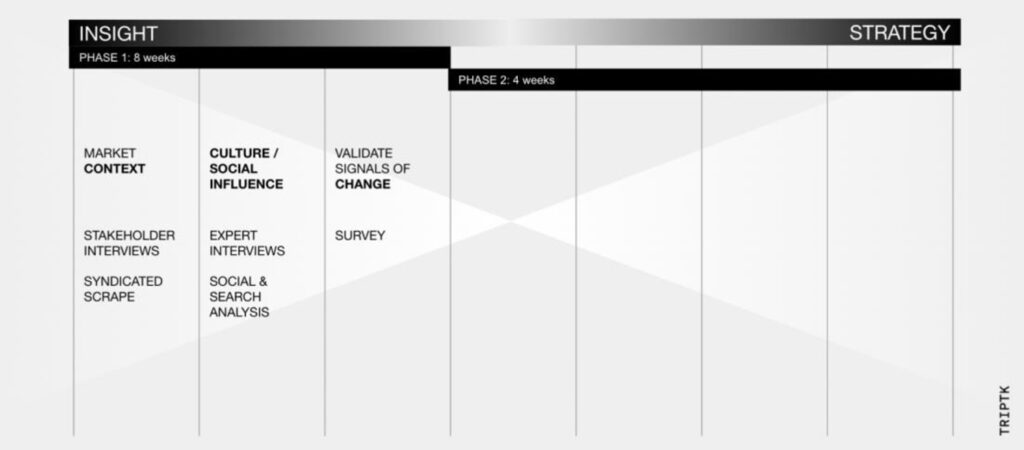

The image below displays the methods used for the insight phase.

Figure 1. The Insight Phase of the What’s Next Desk.

Image by © TRIPTK, used with permission

Rooted in ethnographic and social theory, the What’s Next Desk draws from best-practice ethnographic principles around culture and the notion that people are social beings, socially influenced; similarly, it applies the ethnographic principles of context and change.

It situated consumers and their needs in the context surrounding them – mapped via stakeholder interviews and syndicated data scrapes. It explored culture from the top down, through the lens of global topic experts; and from the bottom up, through the analysis of social chatter and media content. The value of online, behaviorally-led ethnographic exploration is especially relevant if we consider how traditional social cohesion structures were disrupted, and social influence in the digital space was accelerated. Finally, it detected signals of societal change by comparing attitudes and behaviors of leading edge “Prosumers” and Mainstream Consumers in a global, quantitative study.

Table 3. Ethnographic principles, applied with a new approach

| Ethnographic Principles | Methodology |

|---|---|

| Market Context | Stakeholder interviews Syndicated scrape |

| Culture / Social influence | Top-down exploration: industry / cultural expert interviews Bottom-up exploration: social listening & search trend analysis |

| Signals of Change | Survey / quantitative validation |

Build your own What’s Next Desk: Tips & guardrails

Start with mapping your market context – put your arms around the challenge

Context is king, and charting the confines within which to operate is critical to rally a vast client stakeholder team around a single-minded definition of success.

With the kind of expansive question we were tasked to answer (“how is the overall A&F value proposition changing?” – where does one even begin) our first step had to be to sharpen them. On the one hand, we wanted to avoid the classic pitfall of boiling the ocean, and on the other, we saw this as a great opportunity to speak to client-side folks spread across the business – anyone who would eventually come into contact with our deliverables and put them to action. There’s nothing worse than a final report landing on a shelf and catching dust without ever being put to use, and we’ve learned that the first step to avoid that is to listen to – and really hear – what’s truly going to help move the needle for client decision-makers.

How to select who to speak with? We conducted stakeholder interviews with VF team members who were best positioned to define our context: VF Corp team members in charge of all 3 priority regions (NA, EMEA & APAC) were chosen to participate.

Mapping known knowns is a helpful reflex when you’re looking to avoid boiling the ocean. Next to extracting knowns from the VF brain trust, we conducted a syndicated scrape to review existing knowledge already available on topics of interest. The upside of the whole world going through cultural upheaval is that everyone’s aware of it – and many are writing about it, so there’s suddenly a lot of content available on the subject – which can save you a considerable amount of primary research effort.

To assemble our source list, we went broad and deep. Sources spanned industry and consumer reports (e.g. NPD, WARC), articles from within A&F and adjacent industries (e.g. Apparel Coalition, Apartment Therapy) and cultural opinion pieces (e.g. The Cut).

This context definition exercise helped us sharpen the ingoing questions and condensed the universe of existing data and perspectives into crystalized hunting grounds and hypotheses.

By combining stakeholder interviews with our syndicated scrape, we were able to break down our big, expansive questions into more manageable, finite areas of investigation, see example in table 4. We were starting to ask more manageable questions – but also, to ask the right questions, i.e. we retooled questions so they could be answered by each methodology component.

Table 4. Ingoing question and how it evolved into sharpened hypotheses / hunting grounds

| Ingoing question | How is the value proposition in A&F changing? |

|---|---|

| Sample of sharpened hypotheses / hunting grounds: | Will there be a reappraisal of consumption?How will A&F purchase drivers be affected?

Does sustainability matter & impact willingness to pay? Did COVID-19 create acceleration or deceleration effects? |

Next, fill your biggest knowledge gaps with top-down exploration of culture in each market

Armed with a sharper set of ingoing hypotheses, we turned to global experts to shed light on global cultural shifts. Without boots on the ground in each of the regions, TRIPTK had to ensure that the insight generated in these interviews was truly representative of near- and long-term trends in Europe, APAC and North America. We recruited experts in each of these regions – and made sure to include voices from the business and the academic worlds in order to capture divergent points of view.

A key step in our process was to further hone our sharpened hypotheses into questions that covered context, culture and change – like the ones outlined in table 5.

Table 5. Sample line of questioning for Experts

| Context | In the past few years, we’ve seen evidence of consumers desiring fewer, better things.Have you seen this reflected in shoppers from your region? If so, what drives this? If not, why? Any key differences here when you look at your market vs. global? |

| Culture | Are there groups (e.g. younger/older, insulated/constrained) who are critical in defining a new role for brands? |

| Change | In the next 6-18 months,Will brands have to work harder to create value? How? How is this similar or different compared to a previous global crisis (e.g. recession)? |

During this investigation process, a few key narratives surfaced that started to shed light on how deeply COVID-19 was affecting the way consumers think about their wardrobes – and what that means for brands that live in them or aspire to be a part of them moving forward. Here are examples of how the line of questioning TRIPTK evolved for experts (and reported in Table 5 above) yielded targeted insights.

Context: Wardrobes are consolidating

Question: In the past few years, we’ve seen evidence of consumers desiring fewer, better things. Have you seen this reflected in shoppers from your region? If so, what drives this? If not, why?

Sample answers:

Consumers used to have wardrobes for all different occasions but are now consolidating these into a “single wardrobe”. This is driven by casualization, athleisure, and a Marie-Kondo wave of simplification and evolution of consumerism. With COVID-19, people are making even more pragmatic purchasing decisions leaning towards products that offer performance and versatility. – Expert, NPD Group

For a long time, people ‘talked the talk’ about less is more, but COVID-19 is calling people to action. Mindful consumerism is becoming a reality, because people’s shopping habits were cut down drastically for 3-4 months, and it only takes about 6 weeks for habit change to set in. This is a total reset. – Expert, Forbes

Culture: it’s happening to everyone, but people react in different ways

Question: Are there groups (e.g. younger/older, insulated/constrained) who are critical in defining a new role for brands?

Sample answers:

We’ll see more limited, pent-up demand for more special, limited-edition items among better off, insulated consumer groups.

– Expert, CEO & Founder in the Fashion IndustryAlready before COVID-19, mid-range high earners would trade up instead of buying pure luxury brands, indulging in specific purchases rather than across the board. It’s a lot harder for brands to trade up their entire proposition to the luxury space.

– Expert, Forbes

Change: the evolving role of brands and retail

Question: In the next 6-18 months, will brands have to work harder to create value? How?

Sample answers:

Brands like the ones in the VF portfolio tend to be better set up for this shift – going into a fashion world of more stable functional products that will last a long time, will still be styled ‘right’. Stepping away from fads (here today, gone tomorrow), as brands invest more in smaller drops throughout the year and less in fashion show seasons.

– Expert, ForbesPeople will be looking to brand values more than ever: they are key to their story and have aspirational appeal. Big brands will have to act small: limited edition collaborations and collections.

– Expert, NPDPractical value will increase – if you look at the headwind of how increasingly workwear and outerwear values have influenced style – what might argue that practical values (functionality, durability, versatility) gave them a symbolic value in fashion.

– Expert, Nielsen Global Intelligence

A synthesis of responses like these became TRIPTK’s starting point of ingoing, top-down insights.

Then compare and contrast top-down insights with a bottom-up exploration of social influence

We couldn’t immerse ourselves in our target audience’s real worlds – so we turned to exploring their digital worlds instead. We replaced traditional, offline ethnography with online, behaviorally-led ethnographic exploration to complement top-down expert perspectives with real-world consumer behavior. COVID-19 had disrupted traditional social cohesion structures – but it never stopped people from finding other ways to address their needs. As the real world shut down, the digital world took over. More than ever before, people turned to the internet to search for things, express themselves, socialize with others and shop.

Once again, we looked at our ingoing questions and retooled them to fit our methodology. Social listening and trend analysis are at their best when they can answer ‘how much’ and ‘for how long’ – type questions, like the ones presented in table 6.

Table 6. Sample of bottom-up investigation areas for social listening & search trend analysis

| Ingoing question | How is the value proposition in A&F changing? |

| Sample of social listening queries | What terms are most used in online conversations about mindful consumption? And by what target groups (e.g. younger, older)? |

Next, we defined the digital exploration universe by developing keyword and source lists for each region. A digital exploration universe is a dataset that’s defined through the keywords, target users and sources it’s made up of. Each universe was divided into 2 components: topic and trend. Where possible, we looked for differences between consumer cohorts (e.g. gender, age).

- Topic focused on mapping consumer and brand-led online conversation volume and sentiment from the past year. The analysis was conducted in NetBase / Quid, with custom queries designed for each market. To ensure conversations focused on consumer/shopper behaviors, keywords representing each foresight factor were complemented with inclusion terms that signal consumer behavior. This exercise was done in-language for each of the regions of focus. In the case of our sustainability term investigation, we looked for online chatter that included keywords like “Marie Kondo”, “#fewerbetter” and “seasonless wardrobe”

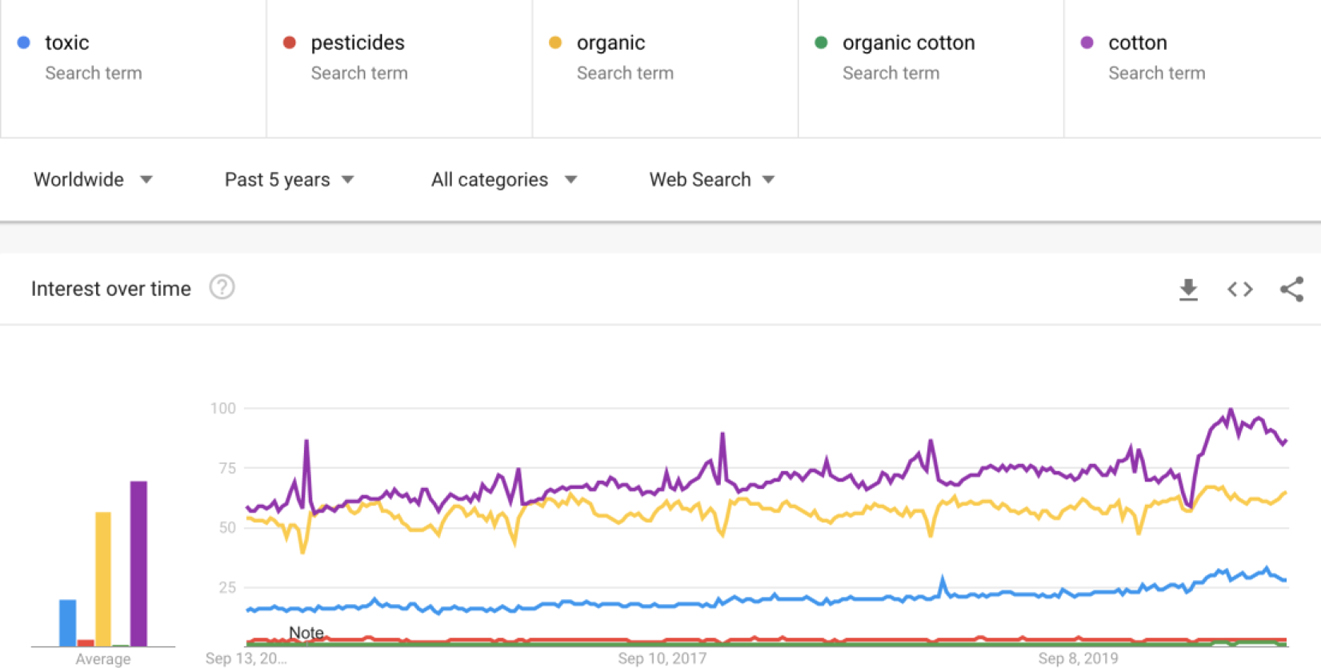

- Trend focused on search analysis, looking for signals of acceleration and deceleration in the things people were looking for or talking about online. To detect short- and long-term trends, and to distinguish between seasonal and ad-hoc COVID-19 effects, we compared data in a set of date ranges on search engines and social platforms like Twitter. In the example pictured below, we investigated how searches for sustainability signals in fashion correlate with searches in other categories, like food.

Figure 2. Sample search trend analysis.

Image by © TRIPTK, used with permission

Finally, validate your hypotheses to anticipate whether change will happen, and where

The work to date had successfully mapped a range of breadcrumb trails, but it had yet to point out which ones were most critical in VF Corp’s pursuit of business resilience. Now that top-down and bottom-up cultural & social influence data were collected, we needed to develop a clear decision-making pathway that picked out signals of significant societal change from a vast arena of potential upcoming shifts.

‘Significant change’ was defined in one of three ways:

- Likely to impact the business within the defined time frame of 6-18 months

- Relevant to one or more markets of interest across China, Germany, UK, US

- Important to at least 1 in 4 of VF Corp’s priority brands

To detect these signals, TRIPTK designed and fielded a survey collecting feedback from 500 respondents in each of the 4 target markets (China, Germany, UK, US). The survey audience included an even split of:

- Prosumers*: defined as today’s leading-edge influencers and market drivers, Prosumers offer insight into trend development and adoption. They typically represent 20% of any market’s population, and largely coincide with the Innovators and Early Adopters featured in Rogers’ innovation curve.

- Mainstream consumers*: representing the remaining 80% of the population, mainstream consumers are likely to adopt Prosumer behaviors 6-18 months later.

Among each of these, the survey recruited VF brand owners/buyers/loyalists (Vans, The North Face, Timberland, Dickies) and measured their income levels, among other socio-demographic markers.

The table below highlights select survey topics covered.

Table 7. Select survey topics covered

| Ingoing questions | How is the value proposition in A&F changing? |

| Sample of survey topics covered: | Number of A&F items bought; spend & future intention to spendProduct & brand attributes important to people when buying A&F; VF and competitive brand performance against them |

DEVELOPING A STRATEGY THAT IS RESILIENT TO SUBJECTIVITY: ARMING VF CORP WITH STEPS TO TAKE IN THE NEXT

Strategic principles

In the thick of the pandemic everyone was craving answers, and falling into the subjectivity trap was inevitable: content about the effects of COVID-19 on society and business exploded online, and business leaders everywhere were piecing together their own insights and plans. But everyone’s content feed is different: a growing body of evidence suggests that newsfeed and social media platform algorithms narrow down what’s available to display customized information to each individual (Source).

The TRIPTK team was not immune to this effect, which is why the strategic principle of data triangulation was rigorously applied at every stage of the process. From the syndicated scrape, when sources were intentionally pulled together by multiple TRIPTK team members to temper echo-chamber effects created by the algorithm; to the final analysis phase, when data from thousands of survey participants, social listening conversations and search trend queries were synthesized to confirm or reject hypotheses. Triangulation across culture, data and business evidence helped develop recommendations that went beyond individual testimony.

Using triangulation makes it possible to apply another strategic principle: prioritizing foresight over insight. Tuning out the noise to home in on signals with the greatest predictive potential is critical to help businesses make decisions with confidence, but also at the speed of culture. We applied this principle by comparing survey responses of Prosumers to those of Mainstream Consumers: higher or lower Prosumer scores became strategic shift markers, while even scores across both groups were interpreted as ‘maintain course’ signals.

While a wealth of data pointed out a myriad of breadcrumb trails, we had to pick out those with the greatest potential to move VF Corp well beyond the current pandemic stage. A third strategic principle was applied: staying laser-focused on delivering holistic & meaningful impact. Of all the data gathered, only what could help VF Corp and its brands move forward was selected to inform the final strategic deliverable.

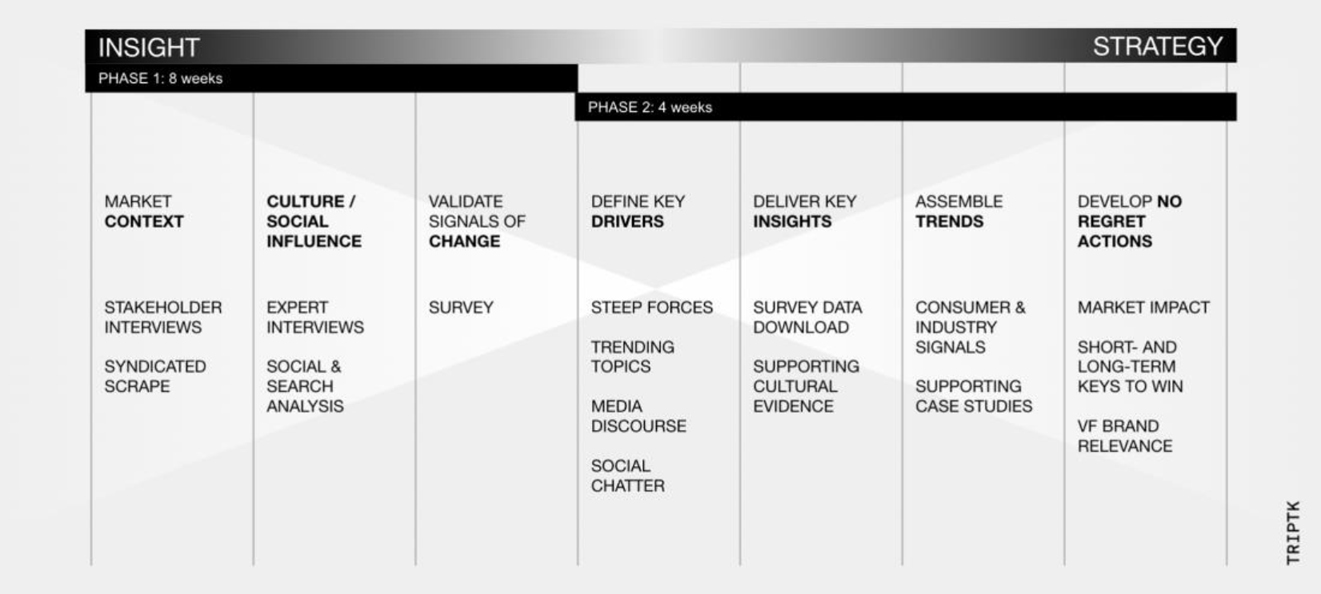

From methodology to strategy

Turning the corner from methodology to strategy didn’t start when data collection was complete. The key to unlocking meaningful strategic recommendations was to reverse-engineer our approach from the start.

Each step in the methodology had to play a specific role – we knew that our survey was the data-collection end point, so we had to build our ethnographic exploration with validation in mind: what questions could we answer at each stage of the exploration process? What questions couldn’t be answered if not in the final validation survey?

At the end of our investigation journey, the survey became the ultimate prioritization tool: not only did it arm us with a sense of what is more or less important within each of our foresight factor investigation areas – it helped us streamline the entire strategic narrative we built for the What’s Next Desk. The image below sheds light on the entire transition process – from insight to strategy.

Figure 3. From methodology to strategy: the transition process.

Image by © TRIPTK, used with permission

Enough with the theory already – let’s take a look at how insight became strategy by showcasing an example. To illustrate the example, we will focus on the ingoing question “How is the value proposition in A&F changing?” – and walk you through the process.

Define Key Drivers

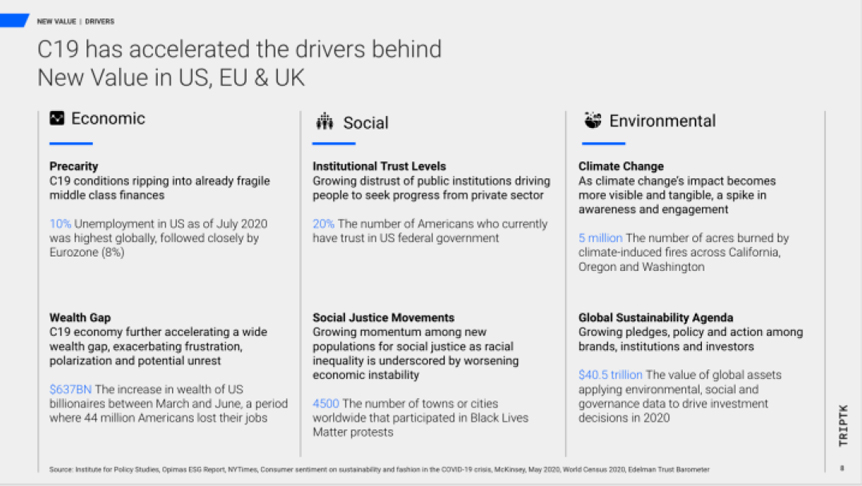

To situate consumers and their needs in the context surrounding them, TRIPTK applied the STEEP forces framework, an adaptation of F. Aguilar’s 1967 PESTLE framework. The acronym represents the 5 forces shaping culture alongside consumer behaviors and attitudes: Social, Tech, Environmental, Economic, Political.

This framework was especially helpful to map signals of change and context drivers: helping VF Corp understand not only what pre-COVID forces were accelerated or decelerated or what new forces were emerging, but also in what markets they manifested more or less strongly. Survey data was used to shortlist which of the 5 STEEP forces had an outsized impact on each foresight factor.

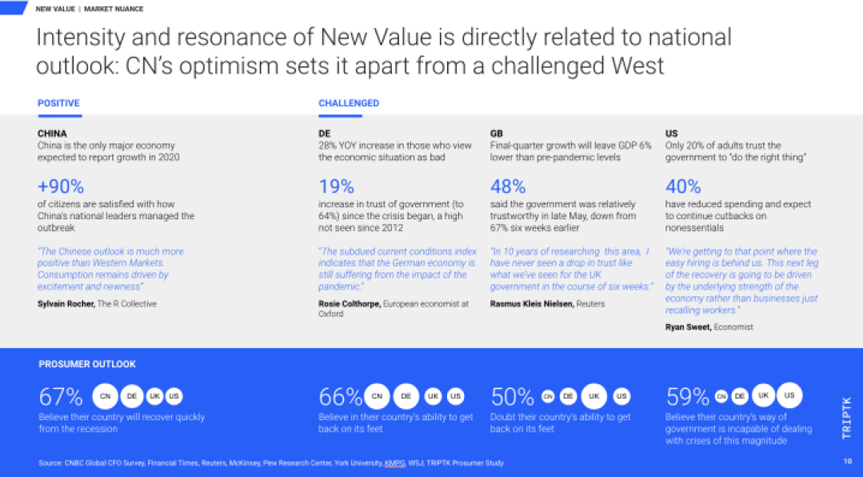

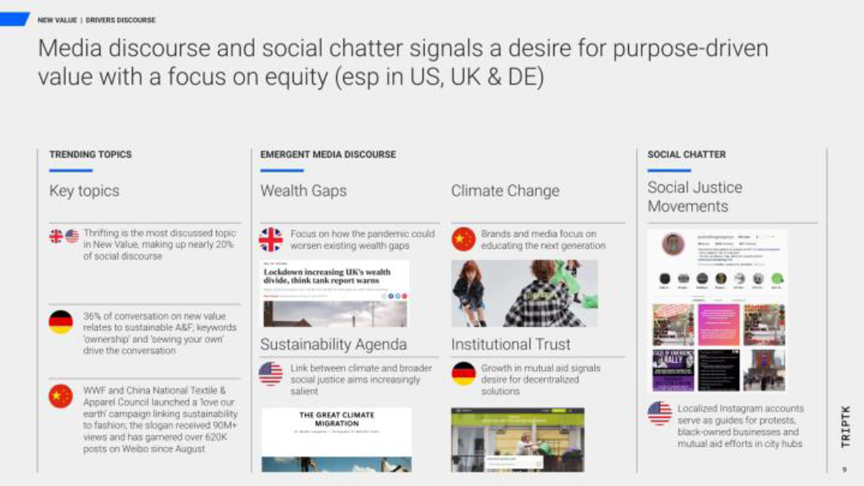

To complement the top-down snapshot provided by STEEP, a synthesis of bottom-up key topics across social chatter and media discourse was included as well. See figures 4, 5 and 6 below for an example extracted from the What’s Next Desk strategy deliverable.

Figure 4. How 3 of 5 STEEP forces play an outsized role in the changing value proposition in A&F.

Image by © TRIPTK, used with permission

Figure 5. Market nuances, setting up how China stands out as a market with a more positive national outlook, which we found has a significant impact on consumer perceptions of value. Evidence includes syndicated and survey data contextualized by expert quotes.

Image by © TRIPTK, used with permission

Figure 6. Cultural and social listening evidence extracted from trending topics & social chatter.

Image by © TRIPTK, used with permission

Deliver Key Insights

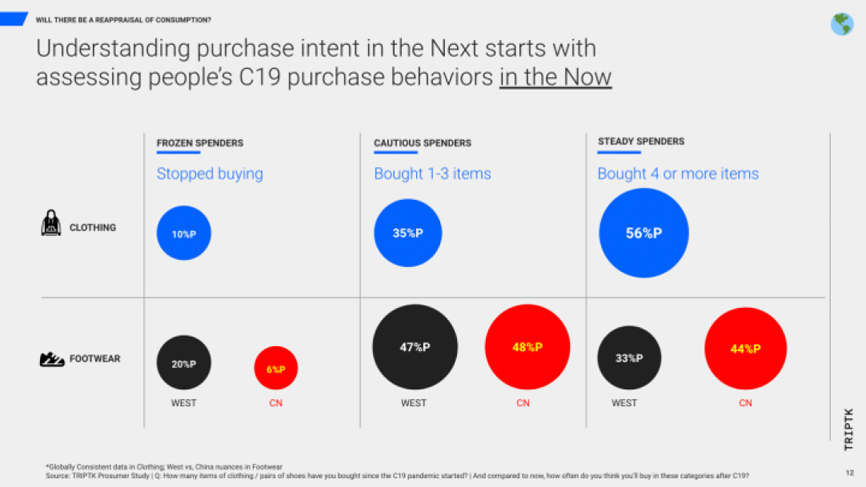

Survey data was instrumental in answering VF Corp’s ingoing questions. We applied a straightforward Q&A approach, and complemented key survey data with supporting cultural evidence in the What’s Next Desk strategy deliverable. The expansive question, “How is the value proposition in A&F changing?” was split into its more refined hunting grounds, each of which became a subchapter in the final deliverable.

Figure 7. A straightforward Q&A approach to answering VF Corp’s ingoing questions.

Image by © TRIPTK, used with permission

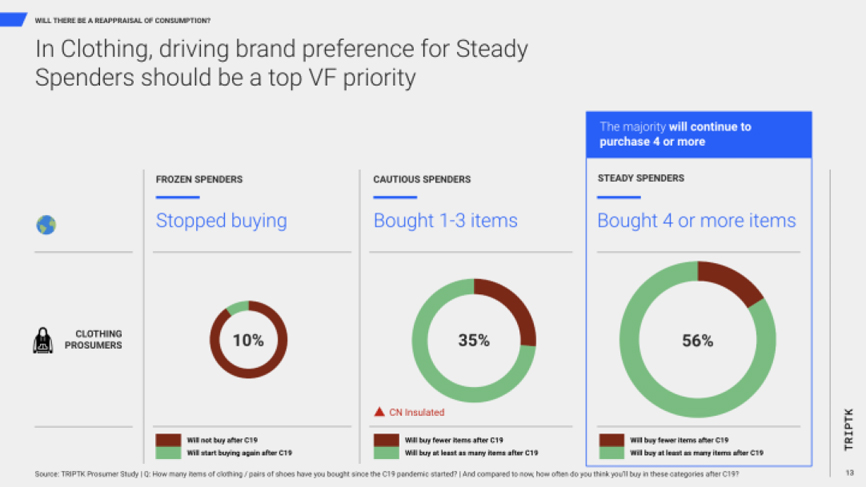

Figure 8. 3 types of spenders identified in the survey, and calls out that they have different incidences in the west vs. in China. Image by © TRIPTK, used with permission

Figure 9. VF Corp priorities moving forward: in a world where spending patterns decline overall, it points out what segments to target in order to maximize sell-through potential.

Image by © TRIPTK, used with permission

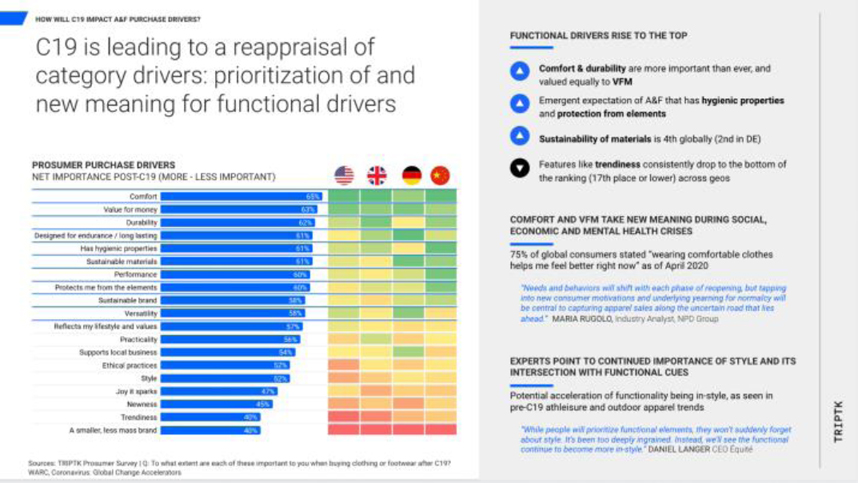

Figure 10. New Value A&F shopping drivers: what people look for when buying in the category. An important finding that surfaced here was that people were no longer trading off between form and function – they started expecting A&F that can deliver on both benefits.

Image by © TRIPTK, used with permission

Assemble Trends

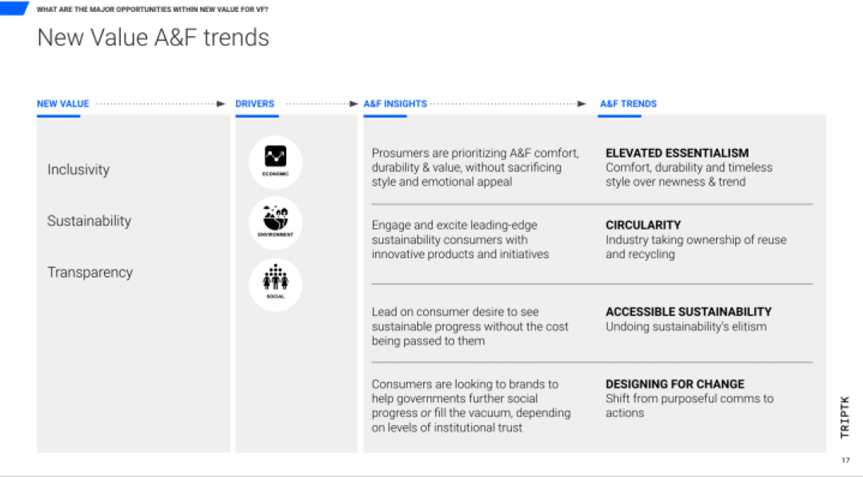

Armed with clear answers to VF Corp’s ingoing questions, TRIPTK went about assembling relevant trends for each of the foresight factors. Trends were developed as a result of combining survey data, cultural and contextual evidence, and social listening insights. Each trend was then supplemented by real-world examples already manifesting in the A&F category when the What’s Next Desk deliverable was compiled.

Figure 11. Each trend is anchored in collected evidence – honoring the strategic principle of delivering meaningful impact. Image by © TRIPTK, used with permission

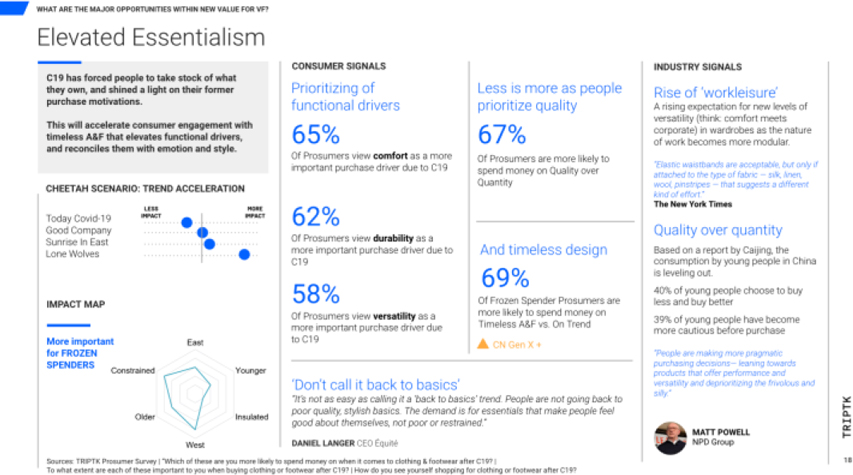

Figure 12. One of the 4 trends surfaced in New Value It includes an impact map which clarifies where and among what audiences the trend will have an outsized impact; consumer signals pulled from survey data and industry signals gleaned from expert interviews.

Image by © TRIPTK, used with permission

Figure 13. Evidence of how this trend is already manifesting in culture, and especially in the A&F category.

Image by © TRIPTK, used with permission

Develop No Regret Actions

Synthesizing the what, illuminating the why and developing a perspective on what’s next (key drivers, key insights, trends) are essential components of strategy development, but they would be incomplete without illustrating the ‘so what’ and the ‘what do we do about it now’ – and in the case of the What’s Next Desk – the ‘what do we do about it next’.

Building on the shortlisted foresight intelligence TRIPTK collected, the team went about shaping implications and recommendations by developing no regret actions for VF Corp and each of its 4 priority brands (The North Face, Vans, Dickies, Timberland).

To develop these no regret actions, TRIPTK linked trends to opportunities in the Next: for each trend, TRIPTK charted an impact map illustrating what target groups VF was most likely to reach by taking action; and pointed out what VF Corp’s current strength was in meeting needs and expectations pertinent to each trend (measured as high, medium or low strength).

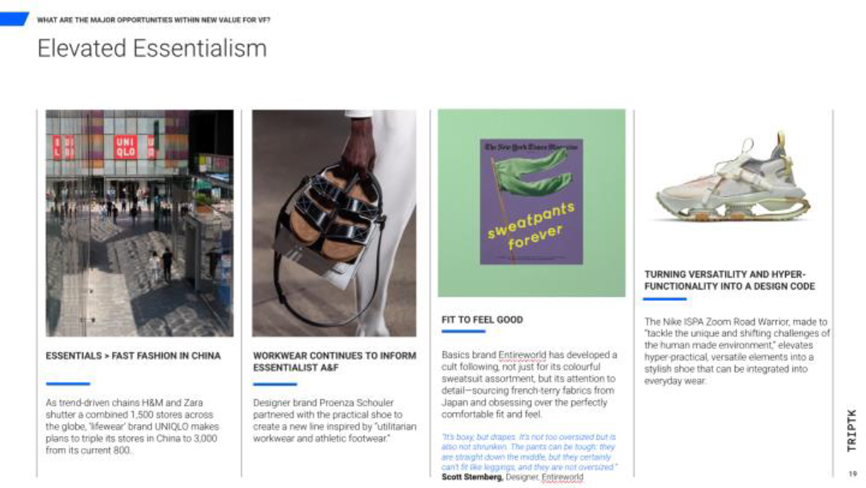

For example: leaning into the Elevated Essentialism trend would require injecting key functional A&F purchase drivers with emotion and style cues that resonated with all spending groups. Doing so would resonate most in Western regions, among older age groups and especially among audiences with lower spending power.

Next, TRIPTK developed no regret actions along the temporal axis – focusing on marcomms and partnership recommendations in the 6-month timeframe, and informing retail and product decisions in the 18-month timeframe. Here are 2 examples:

- Marcomms: leaning into Elevated Essentialism opened up opportunities to champion the essentialist mindset in communications: for Vans, this meant finding ways to celebrate how their target audience, the Expressive Creator, makes the most out of the A&F they wear by creatively assembling outfits and styles in new and unexpected ways.

- Retail: another no regret action TRIPTK developed from the Elevated Essentialism trend pointed at the opportunity to invest in a less-is-more mentality: finding ways to keep exhausted A&F shoppers engaged by offering them a more curated selection of A&F products, even if it meant sacrificing seasonal product ranges to make custom releases and collections shine.

MAKING A GLOBAL BUSINESS RESILIENT TO THE DRAMATIC IMPACT OF COVID-19

Designing for impact

No matter how rich and robust a final project deliverable is, there’s always a risk that it will remain just that – a report that is debriefed upon and that does not lead to changes in the way clients run their business.

In the case of the What’s Next Desk, VF Corp was hankering for answers and strategic direction – because the dramatic impact of COVID-19 had predisposed the business to identify effective ways to implement change. That said, change rarely happens overnight, and there were a few ways TRIPTK and the core client team designed for successful project impact.

- We believe clients are partners, and act as extensions of their own teams: at TRIPTK, relationship building with more than a single project in mind is key. Leading up to the What’s Next Desk, TRIPTK had already worked on brand projects across e.g. The North Face and Dickies, as well as on corporate project mandates. This long-term relationship thinking accelerates return on insight and project timelines, because the ‘ways of working’ wheel doesn’t have to be reinvented every time

- We clearly defined roles and responsibilities upfront, identifying a core client team that was closest to the project and who could not only be our day-to-day contact but also help us navigate internal dynamics to develop the most effective socialization plan. This had to be a very senior team leader with extensive experience in the client organization

- We avoided black-box thinking/doing: the project remained highly collaborative throughout. Weekly status meetings were a regular moment for client and project teams to come together, review weekly progress and steer forward by making key decisions along the way. This meant that at each stage of our methodology, there was room to shift focus, broaden or tighten the aperture as needed. For example, after our stakeholder interviews and the syndicated scan were completed and it was time to focus on expert interviews, TRIPTK compiled a document showcasing key hypotheses and hunting grounds, and reviewed them with clients to ensure the right focus areas were covered

- We made room for multiple debrief and strategy workshop sessions at the tail end of the project – realizing there’s only so much new news a person can absorb at a time, we organized a few data download moments to thoroughly review and discuss drivers, insights and trends; to then dedicate a few sessions to our no-regret actions

- The nature of No-Regret Actions speaks to their impact potential – implementing them will certainly not hurt the business, and can only drive improvement.

Macro impact review

By applying the methodology and translating it into strategy, TRIPTK developed 9 Trends and 23 No Regret Actions (NRs) for VF Corp stakeholders to implement in the near (communication & partnership strategies) and long term (product & retail strategies) – spanning the 6 to 18 month timeframe dictated by the partnership’s temporal challenge.

Of 23 NRs, 70% were implemented across VF Corp’s portfolio and brands, directly contributing to an average revenue increase of 50% between Dec 2020 – Oct 2021.

Looking at revenue increase in more detail:

Table 8. VF Corp Revenue Change Data

| Timeframe | Corporate Revenue Change | Brand Revenue Change |

|---|---|---|

| Q4 FY ‘21, ending in April ‘21 | +23% | Vans: +13% The North Face: +28%Timberland: +25%Dickies: +22% |

| Q1 FY ‘22, ending in July ‘21 | +104% | Vans: +110% The North Face: +93% Timberland: +70% Dickies: +61% |

| Q2 FY ‘22, ending in Oct ‘21 | +23% | Vans: +7% The North Face: +31% Timberland: +26% Dickies: +21% |

Detailed impact review

To unpack how VF Corp actions impacted revenue growth during this timeframe, it’s helpful to examine examples of how select no regret actions were translated into marcomms, partnership and retail/product decisions by VF Corp team members. The below list illustrates a few examples.

Table 9. Examples of No-Regret Actions and VF decisions taken

| No Regret Action | VF Decision | Source |

|---|---|---|

| Invest in a less-is-more mentality | Opening VF’s first-ever multibrand store | Annual Report FY’21 |

| Champion the essentialist mindsetInnovate for access

Partner with circularity pioneers |

Timberland, The North Face launch circular initiatives | Fashion United UKGreen Queen |

CONCLUDING THOUGHTS

The What’s Next Desk was a success in many ways – not only did it help drive confidence in VF Corp’s decision making as we emerge from the global pandemic, but it also gave us at TRIPTK the opportunity to diversify our set of approaches to deep cultural immersion and foresight.

While the Desk in its VF Corp makeup was never repeated in other businesses, parts of it – and especially its underlying philosophy – are continuously applied in brand transformation initiatives throughout our studio. Specifically:

- The approach to foresight: combining the STEEPLE framework with signals of change / Prosumer research and strategic business priorities, helping us frame and deliver corporate strategy consulting projects that help our clients understand what culturally meaningful areas of growth are worth pursuing next to their core business

- The approach to data triangulation is nearly omni-present in TRIPTK projects, because it enables quick turnaround times and provides a sense of insight completeness – instead of relying on a single source of truth, it draws from multiple, different sources and drives objectivity

- The approach to strategy development: thinking through ‘No-Regret Actions’ as a means to arm a business with sensible steps to take and without expecting it to move mountains to reach goals, helps anchor deliverables in corporate and brand priorities, making them more realistic and achievable

Giulia Elisa Gasperi has over a decade of multi-disciplinary consulting experience. To her, numbers are powerful and empowering vessels of meaningful change. Leaders at VF Corp, Netflix and WeTransfer entrust her with turning intimidating data into fascinating stories, best-in-class innovations and white-space growth areas. She’s lived on 4 continents, speaks 5 languages and is an incurable sneakerhead.

REFERENCES CITED

Allen, Stewart, 2021. “Best Laid Plans…An Ethnographic Approach to Foresight”. Accessed September 20, 2022. https://www.epicpeople.org/best-laid-plans-an-ethnographic-approach-to-foresight/

Dujeancourt, Erwan and Garz, Marcel. 2022. “The Effects of Algorithmic Content Selection on User Engagement with News on Twitter”. Jönköping International Business School, CEnSE, and MMTC.

Ettinger, Jill, 2022. “Send Your Old Timberland Shoes Back So the Company Make Them New Again”. Accessed September 20, 2022. https://www.greenqueen.com.hk/timberland-timberloop-recycling/

Rogers, Everett, ed. 2003. “Diffusion of innovations”. New York: Free Press.

Sieck, Kate, 2013. “Move me: On stories, rituals, and building brand communities”. EPIC 2013 Proceedings, ISBN 978-1-931303-21-7. © 2013 by the American Anthropological Association.

Taylor, Erin B., 2017. “Consumer Finance in a Mobile Age: Methods for Researching Changing User Behaviour”. 2017 Ethnographic Praxis in Industry Conference Proceedings, ISSN 1559-8918, epicpeople.org/intelligences.

Unknown, 2021. “Q4 Fiscal 2021. VF Earnings Presentation”. Accessed September 20, 2022. https://d1io3yog0oux5.cloudfront.net/_a6f10960e4aabb0e14402f1e063fb63d/vfc/db/409/78333/presentation/4Q21+Earnings+Presentation_FINAL.pdf

Unknown, 2021. “Q1 Fiscal 2022. VF Earnings Presentation”. Accessed September 20, 2022. https://d1io3yog0oux5.cloudfront.net/_a6f10960e4aabb0e14402f1e063fb63d/vfc/db/409/81591/presentation/1Q22+Earnings+Presentation_FINAL.pdf

Unknown, 2021. “Q2 Fiscal 2022. VF Earnings Presentation”. Accessed September 20, 2022. https://d1io3yog0oux5.cloudfront.net/_a6f10960e4aabb0e14402f1e063fb63d/vfc/db/409/93445/presentation/2Q22+Earnings+Presentation_FINAL.pdf

Unknown, 2021. “Annual Report, Fiscal Year 2021”. Accessed September 20, 2022. https://d1io3yog0oux5.cloudfront.net/_47860bc9dad11bfa8b105689f81e8408/vfc/db/409/78333/annual_report/VF_FY2021_DigitalAnnualReport-FINAL.pdf

Unknown, 2019. “The 10 Most Expensive Items Sold on Grailed This Week”. Accessed September 20, 2022. https://www.grailed.com/drycleanonly/most-expensive-items-grailed-10

Wightman-Stone, Danielle, 2021. “The North Face launching circular re-commerce platform”. Accessed September 20, 2022. https://fashionunited.uk/news/fashion/the-north-face-launching-circular-re-commerce-platform/2021042255111