While ethnography has been integrated into the design research, new product development and corporate strategy, it has been less well integrated into path-finding for new business opportunities. We’ve developed a model for path-finding research that has three core parts: creating a business opportunity hypothesis from social flux, testing and validating the hypothesis, and catalyzing opportunities for the corporation. We provide a case study of how we used the approach around The Data Economy. We highlight three important aspects of the approach: shift of research focus from context to ecosystem; robust action, rather than funnel development for concepts, and present a tool we created called the Business Opportunity Canvas to convey research findings into action. We then highlight the direct implications of this shift for ethnographic projects, from a focus on how knowledge is produced and description of context, to an analysis of society and culture. We have not spelled out the entire process but have created a minimal viable product that can be experimented upon. Keywords: path-finding, ethnography, business opportunities, methods, case study, ecosystem, robust action, innovation, transformation.

There is no magic in this paper. We do not take a failing company, then sprinkle ethnographic pixie dust over and save it. We do not take an ill formed product, an advertising message missing the mark, or magically reveal a new market through the wonders of ethnographic pixie dust. We do take on a relatively serious problem – how can large companies create “transformative innovations” with the aid of ethnographic research. Ethnography partnered in the past with designers for “design ethnography”, but as we are more active in the innovation space, business partners and language emerge as our new fellow travelers. We will suggest this requires a change in ethnography’s main unit of analysis to ecosystem, an enhancement in how we orientate the work and new tools to help translate into a language that matters to large corporations.

BIG BUSINESSES ARE DYING YOUNGER: INNOVATE OR DIE

In 1925 the average life of a company on “the Standard and Poors 90” was 65 years. In 1998 the average life of “the S&P 500” was 10 years (Foster and Kaplan). Large corporations are dying younger all the time. We work for one; we’d like it to live long and prosper. We work for Intel, a Fortune 100 company. The company was founded in 1968. The primary product was memory chips (SRAM and DRAM) until the company pivoted in the late 70s to become one of the largest producers of microprocessors. While microprocessors remain a profitable business, further innovation will be crucial to long-term sustainability of the business.

Consultants have been driving LEAN and AGILE techniques into large corporations but the results seem mixed at best. Startups are not small versions of large corps. They are temporary organizations designed to seek and discover a business model. The experimental and ephemeral nature of start-ups is a key tenant of Lean Startup. The problem of how do more permanent corporation employ these temporary techniques to similarly discover transformational business models is a problem we attempt to explore. The techniques work well for small start-ups but what works for start-ups doesn’t always scale up for large corporations. Further, we are interested in a particular type of innovation – transformative innovation. The innovation models are further complicated by the frequently changing market ecosystem dynamics. While we (anderson et. al. 2013) and others have noted the rise of complexity in the ecosystem, strategies for adaption, especially around innovation, are still emerging. While we have discussed the product introduction path, we want to develop the creation of that innovation first, as well as some additional ways to probe the ecosystem. We adapt the FOC (flux, order & catalyze) model (anderson et al 2013) around product development more broadly to innovation. This paper expands on what changes the flux, order and catalyze approach for our innovation work practices.

Let’s start by grounding our use of the term “innovation.” We track three kinds of innovation–core, adjacency and transformative–as a part of company’s innovation portfolio. Core innovations relate to the existing products we produce. This is a focus on keeping a competitive advantage in a well-defined product space. We are solid in this space. Moore’s Law has driven our core innovations for over 40 years. Technological and manufacturing innovations around processors and Moore’s Law have enabled us to be market leaders. To produce adjacency innovation means to use core competencies to look beyond the current business into a space that is adjacent—for example, taking an existing product to a new customer segment or serving an existing customer with a new product. This has been particularly popular since the Great Recession since it allows leveraging assets for new revenues. Adjacency innovation is a moderate risk strategy, producing good payoffs without massive investment.

Transformational innovations are fundamentally different in mind-set and approach. Transformational innovations are about the introduction of a technology and business model that create an orientation of the industry ecosystem to the company that introduces that technology and business model. Of course, transformational innovation potentially alters the way we live and work. This kind of innovation often eliminates existing industries or, at a minimum, totally transforms them as well. Transformational innovations generally have a company calling upon new or untapped assets. To tap these innovations companies need to build capabilities to gain a deeper understanding of customers. They must learn to communicate about products that have no direct antecedents to both customers and partners. Finally, they don’t develop just a product but must develop markets that aren’t yet mature. Obviously, transformational opportunities are rare. Apple’s introduction of the iTunes business is an example that changed not only Apple but also the entire music industry. This would be in contrast to a core innovation like Nabisco’s repackaging of Oreos into on-the-go snackers (Nagji 2012).

Transformational opportunities are usually considered to be high risk and high reward. Our approach is counter-intuitive and even radical in that we seek to reduce the risk but maintain the high reward. Further, while searching for transformational opportunities, we’ve discovered opportunities that align as core and adjacent innovations for the company. This is a fortuitous outcome of doing the work but discovery of those core and adjacent opportunities should not detract from the overarching objective which is to transform a business whose bases of competition have been shifted by a changing market. This is hard work for any company to do and it requires a massive shift in mind-set as well as innovation practice. The fact remains that while honing innovation processes in the core space over the years, expanding out to adjacencies or making transformational innovations remains a challenge for most large corporations.

OUR APPROACH TO TRANSFORMATIONAL OPPORTUNITIES: FOC it

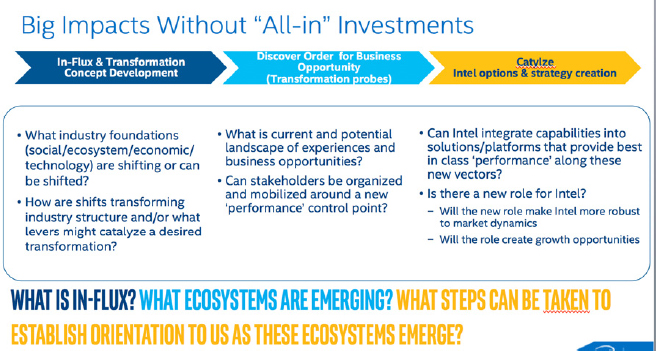

Our approach has 4 key components.

- Sense social and business ecosystems (flux)

- Form hypotheses about the opportunity & market (order)

- Test cheaply to learn, adjust, confirm or disprove (order)

- Invest for commercial success upon hypothesis confirmation (catalyze) We manage these parts through three phases

In principle, our approach is not very different from some lean models.

Figure 1: Three Parts of Our Process

Flux: Industry Transformation Concept Development

There are many ways to begin an innovation process. Management can dictate a direction. Market research can suggest trends to tap. New technologies can emerge from lab products. Really innovation can come from anywhere. The issue is what is appropriate bedrock for transformational opportunities? If the innovation is designed to transform society and/or markets (systems of exchange), then looking for areas that are already in-flux presents unique opportunities (Bezaitis et al 2011). More traditional innovation approaches fail to consider that “the social” is constantly emergent. By emergent we mean that coherent structures coalesce through interactions among the diverse entities of a system; that the system is by definition a dynamic one. Our use of the word in-flux was an attempt to align our approach to what scientists would call strong emergence. Strong emergence occurs when a novel form arises that could not have been predicted. When we first introduced “Flux” as the first component of our overall approach, the example we used was the rise of what became known as “The Sharing Economy”. The Sharing Economy was presented by the mainstream media as the opportunity to collaborate and share that the internet created for people. Instead, we analyzed and presented this shift as one that expressed the changing nature of ownership patterns and the associated emergence of a new social role, the Everyday Entrepreneur. Our starting point for concept development rests on the questions of what industry foundations, whether they are social, technical, business or economic, are shifting or can be shifted to create new opportunities? When foundations of a market shift, a company must either adapt to maintain a meaningful market position but more importantly, with the social and business shifts it creates the opportunities to find new roles or even new markets.

Order: Discover Order for Business Opportunity Search (Transformational Probes)

The questions that drive our analysis of an ecosystem, as well as further probes into the value vectors are linked to how we can stimulate the ecosystem to understand its current dynamics. Additionally these questions provide insight to potential landscapes of experiences and business opportunities. We are literally creating maps of ecosystems to understand the dynamics and rough sense of the terrain. Ecosystems are dynamic systems of relationships. Grasping the outlines of the dynamics helps move us toward real possibilities and potentials. If we can discover the dynamics at this moment well enough, we have the potential to organize and mobilize the stakeholders in the system around our products/services. The maps and probes of the ecosystem help us learn about specific questions and at the same time to understand other paths or opportunities in the space. It is at once a matter of knowing, but also of understanding the possibilities and options we can pursue.

Catalyze: Intel Options and Strategy Creation

While many innovations are possible, even under the constraints of an ecosystem, the question that persists is whether or not the company or a client company one is attempting to transform is the correct one to integrate a new set of capabilities discovered in opportunity search into solutions and platforms that orientate the ecosystem around them. Can the opportunity presented by a changing landscape be understood within a framework that is familiar to the company and to the ecosystem, while preserve the flexibility necessary for future actions and uses. In other words, business opportunities should have characteristics that are familiar to the company so they understand the innovation, even while the same opportunities introduce new variables that ( business models, processes of technologies). Will the new role for the company be robust in light of market dynamics? Will the role create the possibility of robust action with pivots or growth opportunities in the market?

Case Study: Data Economy

In 2010 Intel Labs wanted to reconsider what had been conceived as the user experience for the future of mobility. Mobility had proven elusive to the work in the labs, and a more direct approach to UX was thought to be a possible solution. In thinking through the future of mobility, the team considered the prior 3 years of research around people, technology and business developments. Three items in flux shifted their outcome from a focus on mobile devices to one on mobile data. First, the team offered up the consideration that while people may no longer be mobile, their data was increasingly mobile. Second, the value of personal data was driving billion dollar businesses in the ecosystem. Third, there was a shift in business models and people’s practices from data monetization to participatory value through data.

Taking these three foundational shifts together, hypothesizes were formed around personal data literacy, data analytics, and secure circulation of data. While we continued experimenting around all three vectors in various ways, data analytics emerged as the ecosystem opportunity with greater potential for getting the ecosystem to orientate toward us. We conducted larger scale hypothesis testing around analytics as the next consumer platform (a platform, like Facebook was a platform). We partnered to create The National Day of Civic Hacking (NDOCH) as an event to test our hypothesizes. Taking our learning’s from the NDOCH further explored our possibilities and partnerships through accelerators like our Data Services Accelerator.

The project ended with a Mergers and Acquisitions deal in April of 2015. The method and tools we used were deemed to be valuable tools for innovation at Intel. Throughout the process, ethnographic researchers played key roles, from the discovery of areas in-flux, to the defining of hypothesis to explore potential paths, to conducting probes of the ecosystem, and finally to assisting analysis of the case of a data analytics platform.

KEY CONCEPTS

In this paper, we have quietly introduced three concepts that deserve a broader discussion as parts of a successful innovation plan that has a foundation in ethnographic research. Each of these three concepts represents a shift from practices today. We have suggested that in this type of innovation practice, a key unit of ethnographic analysis shifts from the product or consumer to the ecosystem. We have proposed that a way to approach both our work and corporate strategy is around robust action, rather than traditional funnel or linear approaches to product innovation. Finally, to facilitate the translation of research to corporate strategy we propose a shift away from design tools, like personas and brainstorming, to the use of the Business Opportunity Canvas.

Ecosystem – The Unit Of Analysis

Throughout this paper we have talked about ecosystems. Ecosystems are not a new concept in the business world; however their importance and meaning in this context is slightly different than the usual discussion. When we use the term “ecosystem” we are referring to network of organizations involved in an industry domain through complicated relationships based in both competition and cooperation. The idea is that each business in the “ecosystem” affects and is affected by the others, creating a constantly evolving relationship in which each business must be flexible and adaptable in order to survive, as in a biological ecosystem or Complex Adaptive System. Here we are using ecosystem borrowing from Holland’s understanding of complex adaptive systems (CAS), of which business ecosystems are but one example (Holland 1995, pp. 4-6).

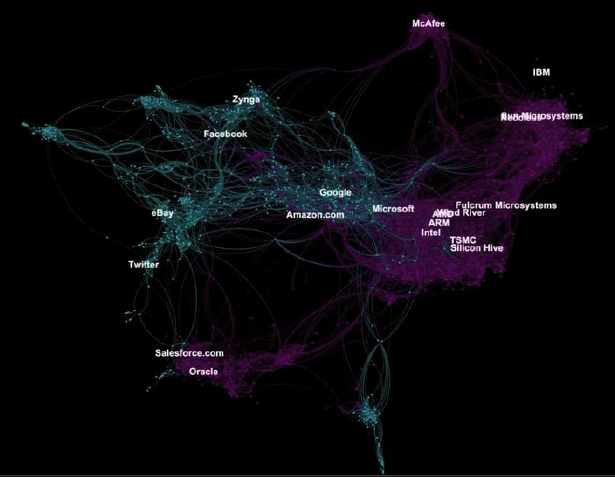

The problem with classic business ecosystem analysis is two fold: (1) it does assume a more or less static ecosystem and (2) the view on the ecosystem usually assumes the company is the center of the ecosystem. We’ve already argued that the ecosystem is not static or even changing at slow pace – change is rapidly occurring. Our shift to an ecosystem as a unit of analysis stems from the work of Moore (1996) around business ecosystems. Most ecosystem analysis is done from the point of view of the company. These traditional types of analyses explore the company’s position relative to everything else. Standards bodies, competitors, investors, government agencies, etc. are thought of from the point of view of the company which is at the center. Our network analysis lets the relations between nodes drive the view of the ecosystem so essentially there is no center and there are always multiple points of view possible. The difference in approaches provides a new perspective on the ecosystem that ironically allows more options for action. The analogy we often use is the shift in views of from Ptolemy’s view of the earth at the center of the solar system over to Copernicus’s with the sun at the center. Does the shift in a view on an ecosystem matter? By looking at the entire system, with us not at the center, we enables a company to see where it sits in the system, what it means for it to be central or more peripheral, and what these positions translate into in terms of partners, co-travelers, etc.

Figure 2. Data Economy Ecosystem 2011

Figure 2 shows one of the ecosystem mappings from the Data Economy program. In this mapping the blue represents the companies that have or are moving to business models that incorporate data as a value. The purple color represents companies that were operating more as traditional (c ~2000) computer technology companies. Here you can see Intel as central to the computing technology part of the ecosystem. Google, on the other hand, is positioned as a central node to the emerging data economy part of the ecosystem, with companies like Facebook and Twitter getting parts of the ecosystem to orient toward them. Being able to see this structure through data visualization tools, allows us to explore the ecosystem dynamics and understand the opportunity spaces.

Ethnography does a great job of identifying invisible forces that shape markets – social, cultural, economic, etc. If we view a market as an ordered system of producers, consumers, suppliers, and partners, the structure of the system, the map, is to a large degree dictated and shaped by the underlying forces. The market system is the organization, or ordered network of participants who seek to get something for themselves (need met, revenue) within the constraints of the forces. So, in effect, while our premise is that a market system responds to changes in the forces (flux), it is the structure of the system that tells us about the details of that response. Like iron filings in a magnetic field – the field is the driving force but it can only be seen by observing the effect on the filings. With modern data and analytics, we are gaining access to the information to see this structure and to test hypotheses about the impact of social and cultural flux on a market system. If we believe, for example, that changes in ‘trust’ and ‘ownership’ will shift a market structure – establishing new values and bases of competition and new aggregations of technology to meet emerging market needs – it is the structure of the ecosystem – investment flows, success and failure of startups, license and partnership agreements, etc. – that is visible and reveals the dynamic structure. A company-centric view misses this perspective, relegating the value of ethnography to a local product or market fit assessment, rather than a market system and social-cultural foundation fit assessment. A single iron filing will only know if it’s pointing north or south, not that it is following the field lines of an unseen force field.

The mappings provide the key communities in an ecosystem, how they interact and connect, or don’t. The examination of the system reveals the key value propositions already emerging in the network. Understanding how the ecosystem is orienting at the moment reveals key control points and the forces of interaction. The mapping also aids in the discovery of the “needs” and more commonly, the combination of needs or value-vectors that the ecosystem is orienting toward; the newer ones that are emerging, and do not yet have the gravitational pull of the whole ecosystem, but perhaps have the potential to shift the system based on the relationships to others in the system. The mapping also provides strategic insight into the white spaces, or the gaps not being filled in the ecosystem. In yet another area of investigation into precision agriculture, John Deere provides an interesting example. When you think of John Deere you probably think about tractors, combines, and farm implements. The ecosystem may extend to small farm, home, other institutional utility machinery and construction equipment as adjacency spaces. John Deere, however, is very active in the data and analytics area. Their activity signals an awareness of what many would think was outside of their ecosystem, but is rapidly becoming a key part of their ecosystem, as John Deere seeks to transform from an era of value creation based on machinery to one that is based on data and analytics.

When ethnography makes a prediction about a shift in the foundational forces that shape a market, we can observe the system response by monitoring the companies in the ecosystem. Or, we can hypothesize what systems might evolve and attempt to test them ourselves. Just as a startup will create a minimum-viable product (MVP) to test a product’s market fit, a corporation can create a minimum-viable system or ecosystem to test if a specific configuration of companies delivering new value can become stable. We can only do this if we: 1) understand the underlying forces at play (via ethnography), 2) hypothesize potential market structures that conform to the forces, and 3) construct prototype systems that expose the new market configuration to market forces.

The focus on an ecosystem clearly changes the role of ethnography in the research. One of the changes has to do with understanding from an emic perspective how key communities might perceive the ecosystem and its needs. The idea of studying systems is not new to anthropologists; in fact anthropologists are very good at systems. We have only to look back to people like Malinowski (1984) who studied objects of trade to understand how an economic exchange system like the Kula Ring worked. The particular system of the Kula Ring, however, was available to all participants so Malinowski could interview anyone to understand the system and its work. Becker (1984), in Art Worlds, described a system where what we think of as a focus, the artists, is really part of a broader ecosystem of institutions and actors. In our case it wasn’t understanding artists or museums, but an understanding of how everyday entrepreneurs made sense of their ecosystem to understand where we could optimally enter into the ecosystem.

The other shift in the ethnographic work is around needs. By starting with an examination of what needs are currently being met both in terms of consumers and other parts of the ecosystem, there is less demand to understand generic consumer needs. With 1000s of companies in a ecosystem, there are 1000s of ways needs are being met. By starting with an ecosystem we can understand whether something innovative requires development or whether a start-up can be leveraged with our own capabilities to drive the orientation of the ecosystem and to meet consumer needs.

Robust Action: Mechanism For FOC Innovation

One of the shifts we are proposing is from “plans and situated action” (Suchman 2006) around future product and service development– where actions are linear toward goals with slight adjustments–to a model of “robust action” (Leifer 1983, 1991; Padgett and Ansell 1993; Eccles and Nohria 1992). Robust action is action directed not at a specific aim, but at maximizing flexibility under conditions of ambiguity. It accomplishes immediate objectives while preserving long-term flexibility. Actions are robust when: 1) they can be made to serve multiple purposes, all of which may not be known when the action is initiated; and 2) past actions can be made to serve new purposes. Robust action maximizes opportunities by positioning organizations advantageously in emergent ecosystems.

The concept originated in the context of understanding individual rational action in situations characterized by high levels of competition and environmental uncertainty, namely competitive chess players (Leifer 1983). Studying the strategic choices of high-level chess masters, Leifer found that rather than being able to think further ahead than their opponents, the best chess players acted in ways that maximized future flexibility even as their strategies and positions evolved. The best chess players didn’t have better strategies, or more foresight in their execution. They exceled at making flexible, multivalent moves to maximize opportunities as the game unfolds. Only when the game reached a point where opportunities to consolidate gains or win outright did these “robust action” players make moves to eliminate uncertainty and flexibility.

Robust action has more recently been utilized in the explanation of enabling of innovation. Here, it has been understood as a distributed process, highlighting action in contexts with multiple actors with conflicting interests and agendas, and focusing more directly on “material artifacts, technology, and sociotechnical systems” (Ferraro, Etzion and Gehman 2015: 372).

For example, robust action helps us understand Edison’s successful development of the electric light. Edison design of the electrical system (the light and its attendant electric generation) was robust, insofar as its details provided “schemas and scripts that are immediately effective in the short term, by invoking preexisting understandings, but that do not constrain us to only those existing understanding and actions, instead allowing us to discover new ways to interact with the new ideas as our understandings evolve.” (Hargadon and Douglas 2001: 488). The electric light solved immediate problems of understandability, while preserving future flexibility about what else we might do with electricity.

In these examples, we begin to see the parameters of robust action applied to product development and organizational strategy. What does multi-valence look like? Are we in an environment of emergence and uncertainty, or one where gains can be successfully consolidated? Most importantly, what are our competitors doing in this, and adjacent, ecosystem? Is our current portfolio of offerings increasing our flexibility, offering opportunities to discover new ways to interact with new ideas? These questions flow directly from an emphasis on robust action.

Robust action is a corrective to the long-standing belief that the proper trajectory of strategic decision-making is to research, plan, design, and then execute. In this view, the ends are relatively clear, as are the challenges organizations face about execution towards those ends. The mechanisms to achieve those ends may change, but the ends are determined a priori. We want to enter a space, or build a product that satisfies a pain point. These are absolutely essential pursuits, but they are methods which work best where: 1) there is little competition; 2) the environment itself is relatively stable; and 3) there are enough research resources to gauge in advance that the ends are the “correct” ones to pursue. As we have described (Anderson et al 2013) these conditions simply do not characterize contemporary technology ecosystems.

Business Opportunity Canvas: Tool for Translation

One of the traditional tools for conveying reach into a form that is actionable is the persona (Cooper 1999). Arnould’s (2013) critic of the persona as an innovation tool has highlighted the strengths and weakness as a research information tool. While the persona remains an important tool for us here as we talk about “experience” (see below) we found we were faced with issues that use of a persona could not address. Given our objectives, we needed to shift from a reliance on design tools like personas to business tools. Our research created a rather complex picture, what is the best way to represent the opportunity while maintaining the sense of complexity? What is the rationale? What is the case to be made: is it comprehensive? traceable? coherent? Can we account for multiple perspectives and multiple dimensions? Too often opportunities are grounded in one point of view – a product innovation, a particular need to address, a persona, and a gap in the market. How do we go further to account for a more complex environment that begs for the incorporation of multiple perspectives, and the development of a more sophisticated, multi-dimensional sense of opportunity?

We’ve found that Osterwalder’s (2010) Business Model Canvas (BMC) is perfectly fine and effective if working with teams on existing businesses, and mapping those business models.. But what if you’re trying to create is a new business opportunity, Osterwalder’s BMC didn’t offer the ability to characterize that opportunity in a way that provides richer, better informed material for new business model development.

So, we developed the Business Opportunity Canvas (BOC) to identify business opportunities and to compliment Alex Osterwalder’s Business Model Canvas, which is a standard tool used in business innovation. The BOC identifies/hypothesizes opportunities, where the BMC tests a specific business model within an opportunity. The BOC helps us to move beyond the hypothesis and experimentation phase to create a coherent argument for the transformative business opportunity (Nagji 2012). The BOC highlights the importance of understanding deep cultural frameworks and the use of ethnography in creating these new business opportunities. The incorporation of ethnography is one of the crucial and fundamental shifts in building on the BMC. Ethnography is not just a component but is key to several contexts in the BOC. We will highlight the ethnographic contribution throughout the rest of this discussion.

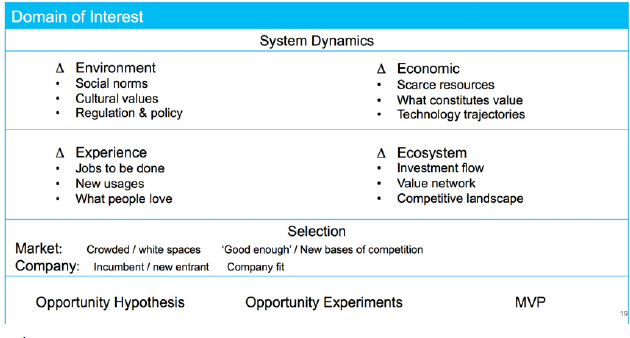

The BOC is for building a business rationale and testing that rationale for its resilience as an opportunity. The BOC provides a tool for ensuring that when you’re designing your business that design is based on multiple dimensions of opportunity. The Dynamic Contexts are the core part of the BOC. We will briefly cover each of these sections. As one works through the tool, the opportunity becomes multi-dimensional by the very fact that a range of contexts informs it. Building evidence across different perspectives helps to build a more complete rationale, a better hypothesis and so a business opportunity is more likely to succeed. The BOC provides a starting point for potential customer segment, value proposition, key resources and activities, and other elements of the BMC.

Figure 3. Business Opportunity Canvas Context Areas

The Dynamic Contexts is the section that diverges most significantly from Osterwalder’s Business Model Canvas. This section builds off of our assumption of a rapidly changing ecosystem in which all business innovation is happening today. We break it out to four key parts: Environment, Economic, Experience and Ecosystem. These dynamic contexts form the basis of where to look and what is to be evaluated and are the foundation of the business opportunity, which without the proper foundation, will not succeed no matter how many pivots an organization is able to take.

Environment

Culture happens. The key is knowing what are potential areas of shifts that provide transformational business opportunities. Trends are seldom transformational; they become something the company just knows and can plan corporate strategy around. Will Gen Z purchasers be different than Gen Y – sure. We can do research on Gen Z and plan accordingly because they will move slowly to become the key targets of marketers and then we can slowly adjust. The fact of no “surprises” also means no unique opportunities. Other areas of culture that are going through more radical shifts that often touches upon the core of culture and society. We have tended to focus around those that have had to do with shifts of moving from an analog society to a digital one. But digitization is not the only arena where this is relevant. One could also explore the fundamental shifts around gender, and what it means to be “male”. We’ve talked about this as moments when culture is in-flux, where there is going to be a new social pattern and potentially different set of cultural values, but it is unclear at some present moment what those are going to be.

Economic

The economic dynamic context involves the things people and industries create and/or believe will be resources to others. Some of these are likely to be under your control and design, like technologies, IP, unique features and capabilities. But often you’ll need to tap into shifts with resources. For the Data Economy work, we considered the rise of data as a resource, and personal data as a resource that had not yet been tapped. A EU Secretary had declared it the new oil and the World Economic Forum was highlighting it as a new asset class (WEF 2011). But technology trajectories are also important. When we did a BOC around Intel’s Galileo and IoT, we considered that 3D printers had become “good enough” to be part of a new economic engine. Broadly speaking, this dynamic context tried to capture the relevant broader economic changes occurring that must be considered for any given business opportunity.

Experience

The experience context taps into what are the key jobs to be done, the new usages that are possible and the emotional context of the offering. The experience gets to the sentiment, beyond the functional elements of a product – the emotional, the personal, ease of use, reliability, and qualitative elements. The iPhone is a classic example where the experience of using a phone changed fundamentally and conferred competitive advantage in part based on the experience. Some industries and markets are based entirely on experience dimensions – ease of use, atmosphere or other qualities, that is, they no longer compete on function. This has been especially true in the hospitality industry – think of hotels or restaurants. The dominance of experience also happens when the functional job has largely reached the good enough point for most customers. Coffee is a great example. Coffee has a clear functional job. You can go to Dunkin Donuts, your office break room, or 7 eleven and grab a cup. But when that job is wrapped in an experience that communicates qualities – like comfort, warmth, coziness, even artistry, it can become a powerful differentiator and dimension of opportunity. Many businesses have capitalized on the opportunity to design compelling experiences around functional jobs and some of the classic examples are Starbucks, the Ritz-Carlton, BMW, and even Facebook in contrast to MySpace. Experience becomes a new basis of competition. Of the four contexts, this one has been the most explored in ethnographic work. Here, ethnographers have focused on the daily routines, the variety of contexts where use happens, the motivations for people using and the responses that people have.

Ecosystem

The ecosystem is another foundational dynamic context to creating a business opportunity. Your company probably has plenty of “market trend” and “social signals” reports, but deep down there is the suspicion that there are two guys in a garage somewhere aiming to eat your lunch. The ecosystem approach creates the ability to discover and capture those two guys, not just the usual sets of competitors and fellow travelers. An ecosystem-based approach captures key components of the market context and the competitive environment. This space has been well documented in the business literature like Kim’s Blue Ocean Strategy or Christensen’s Innovators Dilemma and others as a way to intentionally identify and design disruptive or uncontested positions and to catalyze new markets. Some of the key questions to be addressed in this context are: Is someone else trying to do the same job as you? Deliver on the same value prop? Is it a crowded space? Are there jobs where people are underserved and you have an opportunity to serve them? Are there opportunities to disrupt complacent players in an ecosystem? Are there gaps, white spaces in the market environment? Are there entirely new jobs emerging in the ecosystem that no one is serving?

Selection

Which hypothesis to test and market-system to prototype is a matter of selection based on several business factors. We prefer systems that are distinct from a system we can observe in the wild (i.e. a white space) of an ecosystem. For example, to the test a business model that is not sustainable under the current ecosystem and which we believe might be under the new ecosystem (e.g. non-advertising for personal data). We can test if the bases of competition are shifting because the current product trajectories have reached a ‘good enough’ point for general consumption (new market Disruption). And we can test the ability to democratize what was previously a scare resource, providing more people with a lower quality (than current might end products) but better alternative solution (low-end disruption). Testing these hypotheses positions us to understand bigger opportunities that are not small adjustments to an existing known yet competitive landscape that we might pursue as a new entrant in a field of powerful incumbents. Rather, they identify the emerging control points, or white spaces; the shifting bases of competition, and disruptive opportunities in the ecosystem.

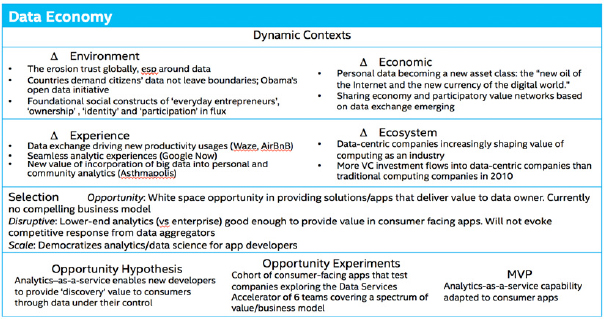

For the Data Economy project we found the greatest opportunity space around providing control to users of the data they themselves created. That is to say, when we started the project people had no control over their data – Google did or Fitbit did, but not the users. This was a giant white space in the data landscape – there was virtually no activity in the ecosystem and no clear business model that would succeed here. We understood that personal use of personal data was an area where Intel could make an intervention given our technologies. We also assessed that personal low end analytics, not at the scale of enterprise analytics, would offer us a disruptive opportunity that was unlikely to get a competitive response from other aggregators going after big margin enterprise business. Finally, we felt we could build a foothold in the app developer community by providing them with a low cost analytics tool.

Opportunity Hypothesis

Even though we are not a start-up, we follow LEAN practices around an opportunity hypothesis (Eisenmann 2011). The business hypotheses is translated into a statement that is falsifiable. The hypothesis is then tested using a series of “minimum viable products,” each of which represents the smallest set of features/activities needed to rigorously validate a concept. Based on test feedback, we then decide whether to persevere with the business model, “pivot” by changing some model elements, or abandon the business opportunity entirely. The hypothesis gives us a focus for information, as well as, grounding robust action. Our working hypothesis around the data economy was we could offer analytics–as-a-service to enable developers to provide ‘discovery’ value to consumers through data under the consumers’ control. The analytics service would enable app developers to create applications with capabilities to rival larger ISVs capabilities.

Opportunity Experiments

Opportunity experiments have taken many forms from webpages to apps to hack-a-thons to incubating companies to investments in start-ups. The experiments were probes into the systems around the core tenants of the core business opportunity for data economy. In this vein we sponsored the first (and second) National Day of Civic Hacking with the challenge of using personal data with larger public data sets. There were over 11,000 participants from 96 cities. Projects from the hack-a-thon became a data for our understanding of the validity of our hypothesis. We were able to experiments with three things: 1) the kinds of business models that might emerge from the participants; 2) the value their apps attempted to address for consumers; and 3) the value of an analytics platform.

Minimal Viable Product

A minimum viable product is one which has just those features and no more that allow you to release a product that early adopters can see and use. The point is that at least some early adopters will resonate with it, pay you money for it, and/or provide feedback. The MVP approach allows for the use of robust action. The MVP is a kernel of the business opportunity vision that solves a core problem, with general feature areas, and is launched to early adopters who would value that kind of solution. The point is also that these early adopters will be the most forgiving and because they can cognitively fill in features that aren’t quite there with just the core of the business opportunity; tent-pole features that indicate the direction where the product will go. Use and feedback from these early adopters is key.

In the Data Economy project, six teams creating consumer facing apps and covering a spectrum of consumer values and business model were selected to be part of a Data Services Accelerator. Amongst other things, the Accelerator provided the teams with an enterprise-level analytics capability for their use. The Accelerator enabled us to test the value of democratized analytics as a service. Further, the app developers were enabling joint use of the data created in the apps, so users could choose if they wanted the data from one of the apps to be shared with other apps. This allowed us to test how developers and consumers might respond to a fuller set of applications at a different scale.

The alternative approach would be to build the entire product, test it along the way, and then release it. The problem with this approach is that it is costly and real world reactions aren’t possible until it is complete and launched. Another approach is to launch and iterate often. The key problem with this approach is the public feedback. While feedback does provide direction, feedback from different groups may be at odds with each other or what you think is right, at which point a new version is going to disappoint some customers. Here we were able to gather feedback, while containing the risk to the future form of the analytics service, as well as managing risk to the corporation.

Figure 4. Example Business Opportunity Canvas Applied to Data Economy

BOC in Sum

Any one of these dynamic contexts can be a starting point. But individually they are not the whole picture. Each is necessary but not sufficient. It’s not just about social environment, the jobs and needs, and customer insights. It’s not just about economics, the product or technology innovation, or a key resource. It’s not just about the user experience. It’s not just about ecosystem, the competitive advantage or a gap in the market. It’s not just about mega trends… . It’s about a synthesis of all of the dynamic contexts. The tool provides the means to assemble the business opportunity, generate discussion and common agreement, a way to compare different business opportunities, and a core set of information that management needs to make an informed decision.

A critical problem is always how to make bridges between the research and action. Tools like personas have attempted to bridge that gap for a particular kind of tool in design and marketing. Personas can support the process of product development, however they fail short on two accounts: (1) they can only account for a very small part of the picture needed to develop a new business model. They focus on just one perspective, the user, and the needs, desires, and constraints of the user. The BOC is multiperspectival. As we’ve demonstrated it is the sum of perspectives gives the BOC power as a tool in establishing the groundwork for a business innovation; and (2) Personas are static. The persona works in part because it can’t be changed. Everyone in a project comes to understand and know the persona. The persona can’t be contorted to the will of the designers, developers or engineers- the persona stands firm (Cooper 2004). Personas enable holding fast to shared values in design and marketing. Part of the power of the BOC’s dynamic contexts is they are capable of change during the development of the business plan. Unlike personas, the dynamic contexts of BOC enable robust action. Of course this flexibility is both the opportunity and greatest challenge for most large organizations who are wedded deeply to traditional, culturally established ways of thinking and acting

BOC is also different than design research. A business opportunity doesn’t emerge out of a set of research that is used to create a workshop or brainstorming sessions, out of which little ever materializes. BOC doesn’t necessarily make people who use it feel hip or creative. It does provide a solid boundary object from which many parts and players in the company can come together to understand what can to be accomplished, how it is going to happen and where the check points are at along the way. It is not as much about “thinking” as it is about “acting” on opportunities.

ETHNOGRAPHIC IMPLICATIONS

For years we have argued for the importance of field research work in strategy and business innovation (anderson et al 2009). The approach we’ve developed makes field research an integral part all along the process of creating a transformational business opportunity. The cornerstone to our approach is an anthropological or sociological understanding of areas in the social-cultural that are in flux – understanding the Dynamic Context of the System. We propose three considerations to ethnography of practice in the business community to address business opportunities: (1) ask the big questions and work to identify directions that are equally big and ambitious, (2) a focus on the knowledge produced not on how it is produced and (3) more emphasis on cultural dynamics, not just the “native” experience. By expanding ethnography in these ways we can not only address issues around design and UX, but also address issues of corporate strategy and business opportunities.

Without a solid corner stone of social practices and cultural values business shifts would not yield successful business opportunities. Tim Ingold (2008) in writing about the state of anthropology and ethnography, draws an analogy between anthropology and art. While, there may be some issues around the analogy, the essay raises a quite important point in this discussion of ethnography’s role for ethnographic work in transformational business opportunity development. He notes that the questions being asked determine the value of the research. Of course Ingold is interested in the big and important questions in anthropology today, especially in the technology area. The logic of Ingold’s argument is appropriate. In the absence of interesting, big philosophical questions about life, society and humanity, the value of ethnographic research to help businesses create transformational opportunities is diminished. Our starting point for business opportunities is exactly the kinds of questions with which traditional ethnographic research was concerned. Ingold’s argument is that in present day anthropology is not asking these questions and suffering as a result; the level of the question scopes the quality and level of production. Of course academics and practicing ethnographers have slightly different orientations. Academics have commitments to ask and explore. Practice research has to be committed to ask and then answer. Still, we worry that the bulk of ethnographic work in and for industry is the same as academia – garbage in, garbage out.

What then are “transformational” kinds of questions that we should be addressing? An area where we’ve been interested at Intel has been around some of transformations that have been occurring, or not, as more of social life moves into the realm of digital. Bill Maurer, at the UCI Institute on Money, for example is asking questions about the meaning of digital and physical when people deal with money and transactions. Basically, going back to classic anthropological questions, these big questions, are about the social nature of economics and exchange. These understandings will be at the core of any transformational business opportunity in digital currencies. In our work, we were interested in the changing role of people in the economic system, particularly as they moved from the classic roles from either consumer or producer to participants. One version of that role was “everyday entrepreneurs” and another was “makers”. Interpreting the shifting roles, changing values, labor dynamics, how that was changing the social underpinnings of society, and what are new forms of “the collective” emerged as a result were imperative to being able to identify and outline transformational business opportunities for the Data Economy project. The key shifts we are proposing in this paper for the EPIC community are from both a focus on how knowledge is produced (methods) and description of contexts to the knowledge we are producing. This is where EPIC started 10 years ago – using knowledge produced in our day jobs to improve theories of the social and cultural in order for us to translate true opportunities to business. The need to return to a praxis approach is more crucial than ever as changing social cultural shift under business models.

We want to be clear, this is a not a shift to be more “academic”, by which we mean start every presentation with the theoretical groundings of the research question and subsequent results. Nor do we feel there is no need for contextual descriptions for design or new methods for us to do our work. Rather, we are requiring that people conducting ethnographic work do that translation, as well as, the translation of field research, appropriately for the business audience. It is not the finance officer’s job to know the importance of performance theory for wearables (or why glassholes emerged) or appreciate the tone of Appanduri’s imaginaries for virtual reality technologies. It is not the engineers’ job to appreciate household dynamics and kinship structures of suburban Brazilians. It is ours job to use these intellectual tools, and so many other, just as we’ve used methodological tools: to build cases around how aspects of the social and cultural hold promise for new grounded opportunities for transformational businesses. It is our job to have rich cultural knowledge to understand social and cultural dynamics to ensure business is on a solid and even lucrative foundation. This type of knowledge is not going to happen only in the 3/3/3 approach of strategy consultancies or 2/2/2/ of design research firms, unless we build our knowledge over time and share it with each other. The EPIC people platform provides a year round space to have discussions around content. The EPIC conference provides a space to codify what we are learning for the community to build upon.

From a methods perspective, we’re not arguing for longer fieldwork necessarily. Let’s take “time in the field” as an example. Mike Agar (2013) recounts two stories where he provided value. In one case, he had been asked to consult about the Thomas Edison Museum in West Orange, and had trouble getting the town to participate in museum activities. Agar talked to one participant at the Chamber of Commerce. The man told him how the factory where the museum was now used to be the lifeblood of the town and source of livelihood for many in West Orange. The company had decided to close this factory and moved the factory to Florida, a right to work state. The result for West Orange was an economic collapse. The factory, now a museum, became both a marker of better times never to return and a betrayal by the Edison Company. People wanted nothing to do with it and wished it was gone. It took him one interview. Just in case you might consider Agar a super ethnographer, another example from Agar is his work on illegal drug use in Baltimore. Agar had been active in drug use research in the ‘80’s but had abandoned the topic for a while. When he came back to the streets of Baltimore in the 90’s, drug use was worse than ever – despite millions of dollars on the “War on Drugs”. Agar conducted a multi-year study of the “why” of illegal drug epidemics in the U.S. He developed the concept of “trend theory” on illegal drug use (Agar 2007) that he could have never done in less than several years.

Let’s be honest: how the knowledge gets produced does not matter as long as the knowledge produced is of value. Many of the tools we’ve used over the years are in part performance art and have been quickly adopted and adapted by market research organizations staffed by business analysts and engineers. Photographs have been a tool that validates the researcher having been “there”, and actually “seeing’ a context as if context is something to be seen. Video clips let the audience “hear” straight from research participants so we know the researcher is telling the true story. Our data visualizations demonstrated we had large sample size and captured “real” data. DScout is touted as innovative ESM (Experience Sampling Method), while the value add appears to be to prove that real richer data (than the 1980s beeper studies) can be collected from real people at real times. In the 90’s we conducted urban safaris of drug locations with drug users in Denver. This was a great method to give funders an experience, a Disney ride of drug life on the streets. It garnered money for research. We learned what was and wasn’t of interest to funders. But not insight – insight was needed before these began. We’ve used similar participatory methods with engineers. Generally they come back converted to needing to do more home studies. We brought “the other” to life in a meaningful and shared experience with them. Powerful stuff. Perhaps insights about what to tweak in the product are learned but basic information to create a transformational project or create a strategic direction fall flat without an understanding of the invisible processes at play. We (Nafus 2006) have documented this pattern before, yet as a community we continue to focus on techniques that demonstrate “the real” or create “real experiences” rather than substantive knowledge created.

The one exception to a lack of concern about methods is the declining use of participant observation, perhaps the biggest threat to our ability to know much of anything of any use. As a community we have moved away from “participating” and “observing” and moved more toward “listening” to what people say. One-on-one, or sometimes called contextual interviews or worse, Skype interviews are excellent at capturing the spoken word but fail to get to important actions or actions that can inform cultural shifts. Talking about reasons for buying a different PC is very different than all the actions and actors that form practices behind the purchase that replaces an existing PC. The shift away from the empirical basis as our foundation exposes us to dangers of credibility and knowledge production. The obvious dangers of over reliance here are (1) we will have no moral or practical authority to highlight differences between what people say and do and (2) as anthropologists from Malinowski on have pointed out, people often can’t articulate the social and cultural structural foundations of their lives. Of course, we need to capture new methods but in the process we need to elucidate how those methods have advanced cultural or social knowledge. Conveying the sense of the “real” is really no longer enough without the addition of new knowledge produced to address key social and cultural infrastructural issues.

Finally, we’d like to change our origin story. Almost every design ethnography or design anthropology talk or paper we wrote or gave in the 1990s quoted Malinowski’s (1984) “The final goal … is to grasp the native’s point of view, his relation to life, to realize his vision of his world” (p25). While this is apt for parts of our work that fall into the Dynamic Context of Experience, it isn’t foundational as we move to business opportunities. As we move into the next decade of business innovation, Geertz poses a stronger starting foundation. “Believing, with Max Weber, that man is an animal suspended in webs of significance he himself has spun, I take culture to be those webs…” Our discipline starts from a place that also says that people, societies and cultures are largely rational, but that rationality is understandable only by knowing the system. If we want to understand why people are doing what they are doing, we have to look at what they assume to be true. Those assumptions are what we take to be culture. If we need to understand foundational shifts, we need to understand the webs and the dynamics behind them, just like we do with networks in ecosystems.

Clifford Geertz, who talks about man <sic> as an animal suspended in webs of significance that he himself has spun— this expression works because it helps us see how people never escape their culture. There is no culture-free existence. Geertz’s statement is important in that it assumes that culture can in fact be changed. Additionally, it leaves open the notion that at any time there are multiple threads of culture happening simultaneously. Finally, it is clear that people can spin new webs and that companies necessarily facilitate the spinning of new webs. For better or for worse, companies participate in culture; in what it is and in how it is lived. Technologies can enable new webs. Or businesses can highlight one web over another. Of course, it isn’t easy to wrestle with the old ones or dominating threads. Parting with the old webs and the creation of new is where our place as cultural translators to business operates. Our purpose is in part to understand how those webs work– to unpack what those systems of beliefs are as they are unfolding. They never completely unfold but they are constantly unfolding. Our job isn’t to capture a perfect picture of the web but a good enough understanding to provide footing for robust action by companies. In the end, robust action is not just how we want to help companies operate but is also how we as researchers should approach our research.

CONCLUSION

Innovation is not magic; it is rigorous work. While running a sustaining business in a known market is coordinated by tested tools and frameworks (Porter Five-Forces Model, Moore’s ecosystem map, model PnLs, etc.), innovation often is viewed as driven by inspiration and even serendipity. Thus, for many companies innovation remains a sprawling set of activities, energetic but uncoordinated. Research happens here. Brainstorms happen there. And decisions are made entirely somewhere else. We find that transformative business opportunities do not emerge from a room full of sticky notes. And yet the imperative for growth through transformational innovation is clear. In today’s dynamic business environment in which bases of competition shift rapidly, what constitutes value changes, and long-held cultural/social constructs are rebuilt, companies must find analogous tools and frameworks to structure the search for new growth opportunities in a changed environment. Recognizing that the search for growth is indeed initially a search challenge (vs. an execution challenge), the tools and frameworks must structure and progressively focus the search through an understanding of underlying market fundamentals (flux), hypothesis of a new market system (order), broad exploration of value creation, and experimentation with value capture (catalyze).

What we’ve presented is a systematic approach to business opportunities that is grounded in multiperspectival research, tested in the real world, and matched to the corporation’s culture. Furthermore, the frameworks presented serve to translate ethnographic insights into more traditional innovation language so that corporations can better absorb the learning and weigh the cost of pursuing transformational options against sustaining investments. The presented approach scales Lean Startup methods, which seek to discover a product/market fit, to corporate scales by seeking to discover a corporate-role/transformed-ecosystem fit.

To succeed in that process, some modification to work as we have known it needs to happen. We have suggested expanding the research focus to shift to include the broader understanding of the ecosystem as that unit of analysis that helps to discover the dynamics necessary to succeed in business innovation. Robust Action, we argued, provides an orientation to both business innovation and research that is necessary in a time of dynamic change. We offered the BOC as a tool that incorporates and translates different types of ethnographic field research into a form that is both usable and actionable in a business environment. Finally, we proposed a shift of the importance of ethnography from how knowledge is produced to the actual knowledge produced in order to focus on the social and cultural in foundation of business innovation. By following our best known methods on how to manage business innovation as an integrated complex system, we can harness ethnography’s energy and make it a reliable driver of growth.

ken anderson is an anthropologist and Principle Engineer at Intel Corporation whose research explores areas of cultural-technological flux. Ken’s over 25 years of publications on research about culture and technology have appeared in computer, anthropology and business venues. ken.anderson at Intel.com

Peter Levin is an economic sociologist, working as a research scientist at Intel Corporation. He has 10 years experience studying financial services, organizations, and the transformation of markets. He joined Intel two years ago, working at the intersection of experience and business solutions. Peter.Levin at Intel.com

Brandon Barnett is Director of Corporate Strategy for Intel Corporation. He currently specializes in the dynamics of ecosystem transformations that reshape industry landscapes. He serves on number of innovation boards and he has published in a range of business and technical journals. Brandon.Barnett at Intel.com

Maria Bezaitis is a Principal Engineer at Intel and directs the UX Pathfinding and Platform team in the Intel Experience Group. She specializes in social insight for business transformation. Maria serves on advisory boards and is President of the Board of EPIC. Maria.Bezaitis at Intel.com

REFERENCES CITED

Agar, Michael

2013 The Lively Science: Remodeling Human Social Research. Minneapolis, MN: Mill City Press.

2007 Dope Double Agent: The Naked Emperor On Drugs. Lulu.com

anderson, ken, Tony Salvador and Bandon Barnett

2013 “Models in Motion: Ethnography Moves from Complicatedness to Complex Systems”.” Ethnographic Praxis in Industry Conference Proceedings 2013, pp. 232–249

Appadurai, Arjun

1996 Modernity At Large: Cultural Dimensions of Globalization. Minneapolis: University of Minnesota Press

Becker, Howard

1984 Art Worlds. Berkeley: University of California Press.

Bezaitis, Maria and ken anderson

2011 “Flux: Changing Social Values and their Value for Business.” Ethnographic Praxis in Industry Conference Proceedings 2011, pp. 12–17

Brown, Tim

2008 “Design Thinking,” Harvard Business Review. June.

Cooper, Alan

1999 The Inmates are Running the Asylum. SAMS, ISBN 0-672-31649-8

Eccles, Robert G., and Nitin Nohria.

1992 Beyond the Hype: Rediscovering the Essence of Management. Cambridge, MA: Harvard Business School Press.

Eisenmann, Thomas R., Eric Reis and Sarah Dillard

2011 “Hypothesis-Driven Entrepreneurship: The Lean Startup.” Harvard Business School Background Note 812-095, December.

Ferraro, Fabrizio, Dror Etzion, and Joel Gehman.

2015 “Tackling Grand Challenges Pragmatically: Robust Action Revisited.” Organization Studies 36(3): 363-390.

Foster, Richard and Sarah Kaplan

2001 Creative Destruction: Why Companies That Are Built to Last Underperform the Market – and How to Successfully Transform Them. New York: Crown Business.

Hargadon, Andrew B., and Yellowlees Douglas.

2001 “When Innovations Meet Institutions: Edison and the Design of the Electric Light.” Administrative Science Quarterly 46: 476-501.

Holland, John H.

1995 Hidden Order: How Adaptation Builds Complexity. New York: Helix Books (Addison Wesley).

Ingold, Tim

2008 “Anthropology is not ethnography,” Proceedings of the British Academy, 154, 69-92.

Kim, W. Chan and Renee Mauborgne

2005 Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant. Boston: Harvard Business Review Press.

Leifer, Eric M.

1983 “Robust Action: Generating Joint Outcomes in Social Relationships.” PhD dissertation, Department of Sociology, Harvard University.

Leifer, Eric M.

1991 Actors as Observers: A Theory of Skill in Social Relationships. New York, NY: Garland.

Malinowski, Branislaw

1984 Argonauts of the Western Pacific. New York: Waveland Press.

Maurer, Bill, Taylor Nylems and Lana Schwartz

2013 “When perhaps the real problem is money itself!: the practical materiality of Bitcoin.” Social Semiotics. Vol23, N2, 261-277.

Moore, James

1996 The Death of Competition: Leadership and strategy in the age of business ecosystems. New York: HarperBusiness. ISBN 978-0887308093.

Nafus, Dawn and ken anderson

2006 “The Real Problem: Rhetorics of Knowing in Corporate Ethnographic Research.” Ethnographic Praxis in Industry Conference Proceedings, 2006: 244–258. doi:10.1111/j.1559-8918.2006.tb00051.x

Nagji, Bansi and Jeff Tuff

2012 Managing Your Innovation Portfolio. HBR , May. https://hbr.org/2012/05/managing-your-innovation-portfolio (accessed July 16, 2015)

Osterwalder, Alexander and Yves Pignuer

2010 Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers. John Wiley and Sons.

Padgett, John F., and Christopher K. Ansell

1993 “Robust Action and the Rise of the Medici, 1400-1434.” American Journal of Sociology 98: 1259- 1319.

Salvador, Tony, Genevieve Bell and ken anderson

1999 “Design ethnography,” Design Management Journal, 10(4) 35-41.

Suchman, Lucy

2006 Human-Machine Reconfigurations: Plans and Situated Actions. Cambridge: Cambridge University Press

World Economic Forum

2011 Personal Data: The Emergence of a New Asset Class. New York: World Economic Forum.