This case study demonstrates the value of ethnography and qualitative approaches in Latin American industry, where national, sociocultural, political, technical, and economic factors create a diverse and challenging landscape for localization. It focuses on the commercialization of a 3D engineering software solution produced by a multinational company, and the regional management and “value-added resellers” that bring it to national markets. The study describes the process of Techno-Ethnographic Consulting, including the research proposal, methods, deliverables, sources of friction, and approach to building acceptance for qualitative work among sales and engineering partners. The project helped struggling sales and technical teams meet their goals, produced improved sales materials, increased commercial meetings, created a new market segmentation, and shifted sales and innovation from a software-centric mindset toward one focused on industry-specific needs and solutions. Keywords: B2B, software, industrial sector, marketing, qualitative research, LATAM

A 3D ENGINEERING SOFTWARE FOR A GLOBAL INDUSTRY

In engineering and manufacturing in the industrial sector, 3D technologies have taken an irreplaceable role since the late twentieth century. Among the most important 3D engineering software on the market is SOLIDWORKS, with almost 4 million users worldwide by 2023.

For this case study we will show how marketing segmentation and content quality was improved in a SOLIDWORKS distribution company in the Latin American industrial sector. To do this, it was necessary to promote and conduct qualitative research that would answer why it is more difficult to commercialize SOLIDWORKS in some countries than in others. Specifically, we wanted to know the idiosyncratic factors that should be considered, in addition to technical and economic variables, for the commercialization of this software.

SOLIDWORKS was developed by SolidWorks Corp., with headquarters in the United States, which in turn belongs to the French corporation Dassault Systèmes. SolidWorks Corp develops the software and distributes it through partners (known in industry as VARs or Value-Added Resellers) located in most countries. VARs are responsible for following the general brand guidelines develop by the parent company and offering the product locally to their respective countries.

Its clients are industrial companies that have engineering and manufacturing departments. Its wide portfolio of software solutions is used in verticals such as machine and structural design, metalworking, mold design & plastic products, Oil & Gas, automotive sector, among many others.

VAR, Headquarters and Corporation Relations

The Peruvian VAR classifies as a medium-sized company—an SME with approximately 25 employees. Its portfolio of products and services consists of 3D design and simulation software for engineering, and 3D scanners for mechanical and industrial design.

As a VAR, its sales guidelines, pricing, brand, and technical aspects are mostly determined by the direct management of SolidWorks Corp. and mediated by a regional management (LATAM) based in Brazil. The regional management tries to support VARs with their sales goals and marketing strategies to achieve them.

This Peruvian VAR was directed by its owner and Commercial Director. Under her management are the Sales, Marketing and Technical teams, as well as a financial manager. At the time of this research, the technical team was relatively small (5 people), serving primarily to Sales team as internal customers, and to SOLIDWORKS clients as external customers.

SOCIETY, TENSIONS AND DIFFICULTIES IN INDUSTRY

Although regional managers provide technical and commercial training to improve VARs processes, it is difficult for them to understand in depth the particularities of each country. LATAM VARs share this challenge. They all know, at least intuitively, that the idiosyncratic variability of each country has to be considered too, besides the difficulties inherent in industry.

For instance, in the Peruvian case, the VAR organizational structure was hierarchical, functional, and process-based (Zapata, Gerardo and Hernández 2017, 72-76). In the country, this hierarchy is not only organizational and typical of companies, but it is also a social expression common to most institutions: guidelines are usually vertical, and dissent to authority and collaborative discussion are not preferred.

This verticality from authority is noticeable in power relations between employer and employee, foreman and worker, teacher and student, house owners and service personnel, school principal and student parents, etc. These same power relations were also observable within the client companies in the industrial sector, and shared too by the Peruvian VAR owner, who directly established the Sales and Marketing strategies.

At the same time, informality permeates Peruvian society (70% of informality index) and is visible in the internal processes of companies, including the private sector. In the Peruvian VAR, the internal processes were not fully defined, which resulted in disorder and incorrect tasks prioritization. Consequently, the work was very tough, often unnecessarily.

The work environment in Peru is additionally of long labor hours, pragmatic, impetuous, tough, and disorderly. In this context, effort associated with work is often valued more than the results. This hard work style is known as chamba in Peruvian jargon. In fact, a very popular saying in the country is “soy chamba“, as a positive value of being an audacious and resourceful hard worker.

In this sense, both the guidelines verticality and the informality of internal processes in organizations create frictions to promoting new research methodologies and theoretical approaches to business problems. If market changes or if a deepening understanding of clients were needed, a bossy leadership and internal process improvisation would increase the resistance to necessary adjustments. Regarding the positive perception about hard and practical work, this is also an impediment to the implementation of new technologies, like advanced engineering software.

Another friction point is related to the industrial business praxis itself. SOLIDWORKS sales were not entirely driven by classic B2B strategies, but primarily by relational marketing, or trust-based relationships. Basically, this consists of removing one by one all the formalities and corporate “theatrical masks” (Goffman 1959) between sales representatives and prospects. These masks or formality layers consist of the codes and behavior required within the industrial spaces: style and topics of conversation, appropriate clothing, professionalism, diplomatic way to solve problems, privacy of information, among others.

For instance, the entire process and experience of scheduling a meeting and visiting a client inside a factory, including the almost-penitentiary architecture of the facility, and the protocols and good manners in dealing with the people of these spaces, are barriers that prevent the sincere expression of needs and preferences between the suppliers and the client. In fact, the visitor treatment regarding industrial security is similar to prison treatment, almost omni-disciplinary (Foucault [1975] 2002; 216).

We can see this through a typical business day. The sales representative shows up at a small window outside of the tall walls of the factory (some of them with turrets). A security guard checks their identity, dress code, and electronic devices. Weapons, cellphones and cameras are forbidden. After a meeting confirmation, the sales representative must walk through a pedestrian crossing marked on the floor while being guide by the security guard. The salesperson is then guided to a waiting room where he will be received by the client. The supplier and client will finally discuss needs and solutions, all under an implicit code of good corporate manners. This whole process is even more bureaucratic and rigorous if the site is a mining plant or militarized factory.

As a professional, the sales representative must leave the best possible technical impression and economic proposal, but only the subsequent and friendly follow-up, through phone calls and subsequent visits, is what manages to relax the overstructured interaction with the client. Thus, the sales representative can discover what are the real motivators behind the technical needs discussed.

B2B MARKETING LIMITS

The combination of Peru’s social reality and the restricted access of industrial companies was so complex that could not properly address the clients needs and an adequate marketing content from the typical practice of marketing and sales.

SOLIDWORKS promotional content and demonstrations were created based on the technical needs of developed countries and mainly related to engineering innovation. For the reasons explained above, it was difficult to promote their commercialization in the Peruvian industry. In fact, innovation has always been a difficult challenge to face due to a variety of technical, economic, institutional, and sociocultural causes, according to Sagasti (Sagasti 2003).

Consequently, a regionalization for content and sales pitch based on the real needs of local industrial market was necessary. This was evident from a marketing point of view, whose professionals understand the importance of focusing products and services centered in the customer’s needs and behaviors. Even so, in practice, planning and execution of in-depth research methodologies is rarely applied by marketing teams of Latin American industrial companies, which prefer to use and limit to quantitative methods.

With quantitative data, obtained mainly through surveys and technical-commercial dashboards, the VAR could only know how many customers it had, the general segmentation of buyer personas, which were the best clients, sales goals, sales income, and what were the technical supports carried out.

But by not delving deep enough into the clients context, the sales and technical teams were exhausted and struggled to achieve the required commercial goals. For instance, because technical demos were generic, they had to be repeated and refined through several meetings. It was necessary to over-explain the software benefits as the technical team had to work more to compensate for the lack of software customization and required. Because clients required full-time consultation rather than simple technical support sales cycles lasted several months.

The Need for Qualitative Research

Having observed these difficulties between 2014 and 2017, the researcher (as Applications Engineer) actively promoted the practice of qualitative methods to regionalize technical demos and improve marketing segmentation1.

At the time, the client segmentation offered by the Marketing department consisted in industrial sector companies that had technical areas dedicated to design and manufacturing products, and that also had enough budget to acquire solutions such as SOLIDWORKS. It was a generic technical and financial segmentation.

The personas were divided by type segmented as engineering managers, supervisors (or team leaders) and technical designers:

- Engineering managers: In charge of leading the engineering team, in addition to planning budgets and development times. They are the ones who would make the decision to buy the software, and their motivations to buy it would be more economic than technical. They are passionate about creation of new products and their launch to market.

- Supervisors/leaders: They are the leaders of the different engineering disciplines involved in the product design cycle and manufacture. They are the ones who authorize the final design and the step towards manufacturing. They constantly evaluate possibilities for continuous improvement for their teams.

- Technicians/Designers: They are the designers and calculators in the team who draw the blueprints and work on the iterative design stages. They want to get the job done quickly and communicate their designs through modern digital technologies.

To provide more culturally relevant segmentation, qualitative research was carried out in 2020. This research also addressed a new question. To understand why it is so difficult to sell SOLIDWORKS in Peru, the research team encouraged sales and marketing teams to first answer a different question: What are the techno-cultural factors of the engineering departments in the Peruvian industrial sector that affect commercialization of SOLIDWORKS?

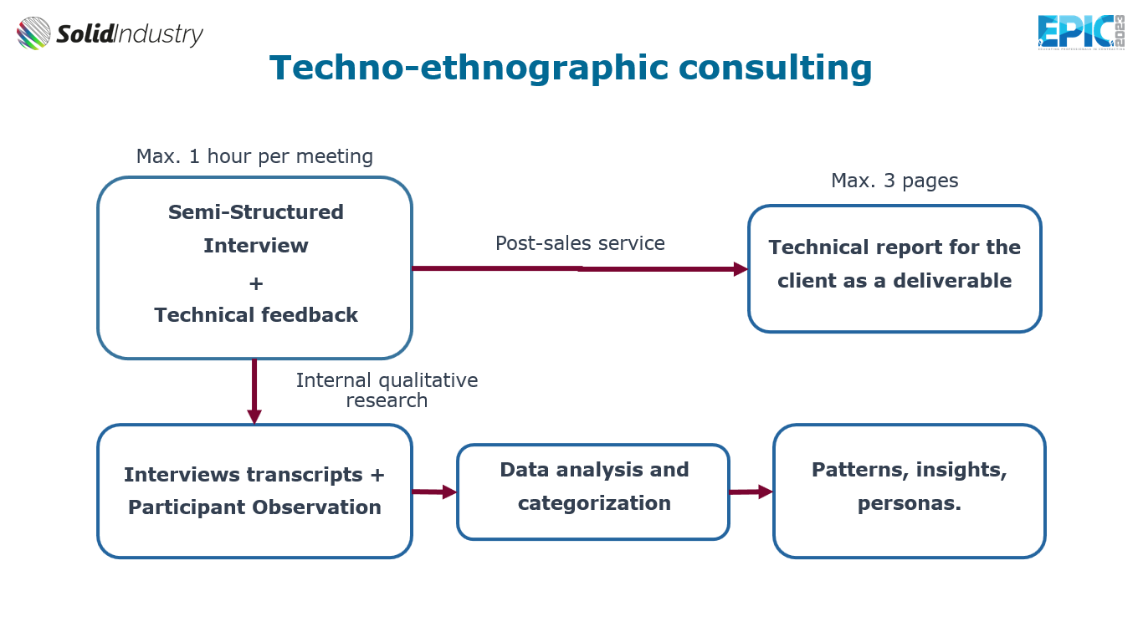

METHODOLOGY: TECHNO-ETHNOGRAPHIC CONSULTING

To introduce the qualitative research into Marketing processes, and at the same time overcome the resistances of these corporate-industrial spaces to this research, I proposed to transform semi-structured interviews into a set of free consulting projects for clients. This technique was also complemented by other methods such as participant observation and autoethnography both with the VAR organization and client companies. At the end, during the consultancy/interviews, I explained to the interviewees that their information would also be analyzed to provide a better service and customizations for the VAR marketing contents. Each one of them agreed and appreciated it.

Other sources of qualitative data came from Sales and Technical teams, through text messages and WhatsApp voice messages, email reports, LinkedIn and Facebook web pages, as well as brief verbal reports with VAR managers in the form of follow-up conversations.

The entire research project was executed in 12 weeks. This is in line with the average research time observed in similar projects executed within the private sector, which is usually estimated at 10 weeks (Isaacs 2016).

Research Results

In contrast to generic marketing segmentation, through qualitative data we found a new way to describe and classify customers. After analyzing the gathered data, we found four different personas beyond the known stereotypes. Namely: The Chambero (hard worker), the Apprentice, the Expert and the Administrator.

- Chambero: The profile most frequently found among the interviewees. They want to compensate their academic studies with courses and certifications that guarantee recognition in their work and a better position in their organizations. SOLIDWORKS means for them an opportunity to leverage their career through new certifications. At work, they just want to get the “chamba” done without many complications, and this preference is transferred to the software expectations. Their approach to problems is very pragmatic (accordingly to Peruvian society), closely linked to manual tasks and manufacture. They do not like theoretical approximation to problems resolution. The software is just another tool that stays at work because they do not use it at home to continue with the responsibilities of the job.

- Apprentice: Sincerely interested in learning, although they would also like to be validated through certifications. They are the ones that interacts the most in social networks and participates in marketing events (webinars, workshops, brand launches). They are persuaded through real cases studies in industry and research projects. This is the persona that best adapts to changes and new products.

- Expert. They have a lot of experience using SOLIDWORKS and even try to develop customized solutions, integrating it with other software or tools. They use SOLIDWORKS at home to gain deeper knowledge. They are enthusiastic about marketing events only when it comes to advanced demonstrations. They are usually engineers (they are not neither technicians nor managers). They may sometimes express or imply that SOLIDWORKS falls short regarding their purposes. When they accept meetings, they ask for a general demonstration of all the software capabilities. They are only persuaded by technicians whom they consider their peers at the level of specialized knowledge.

- Administrator: They are people who are not usually very interested in technical details. For them, all 3D design software is pretty much the same. They want their projects not to be delayed or expensive. They are persuaded if they receive help o advice to get more customers. They want to be perceived as a good managers, businessman or administrators in their organization. They are only persuaded by experts or another administrator profiles.

The personas we found differed from the Marketing segmentation based on managers, leaders, and technicians. Unlike the original premise, concerns and motivators of these profiles are not rigidly structured by roles but are equally manifested regardless of the position. An engineering manager can be as chambero as the technician, a technician can behave like an expert, and a supervisor can fit into the apprentice profile. Therefore, technical or economic interest does not depend so much on the role but on the organizational culture of the client.

Most of the engineering areas observed in Peruvian industry are basically technical areas, where many of its members are more designers than engineers. Their interests are closer to manufacturing than to the creation of new products. In fact, almost none of the personas obtained expressed an explicit interest in innovation, in contrast to the marketing prerogatives from SolidWorks Corp.

Instead, they wanted to take advantage of the software and its popularity to get certified and compensate for the lack of formal education (difficult to access in the country). By becoming internationally certified in SOLIDWORKS, they would have more credentials to move up in their career.

The few companies that expressed interest in innovation were those made up of multidisciplinary engineering teams, with more than ten team members. These would be the right fit for a software like this.

At the same time, we discovered that in addition to technical needs and budget, the right candidates to buy SOLIDWORKS must have a “technological maturity” or “cultural suitability” so that they understand this type of software solution and its workflows.

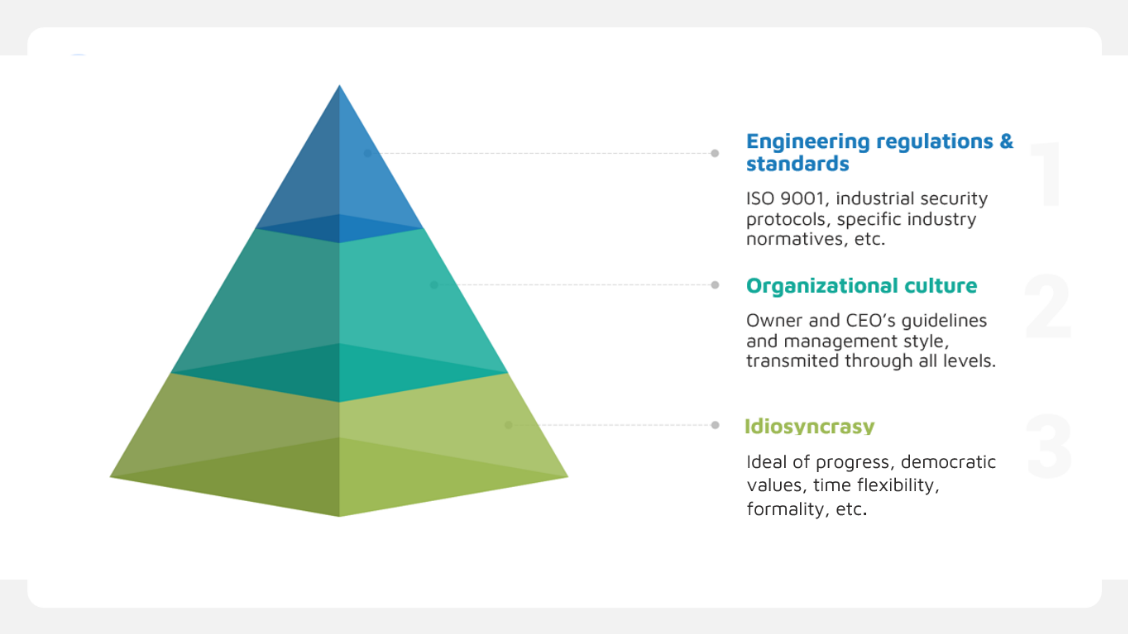

Cultural suitability means that, within industrial sector, in areas of Engineering, IT and Purchasing, there is a system of social factors, values, behaviors and relations (internal, between workers and leaders; and external, between the company and its suppliers) that grow into a specific organizational culture. This culture intervenes directly in the negotiation, purchase, implementation, and post-sales of technological products.

This is where society idiosyncrasy intervenes in the technical aspects. Among the techno-cultural factors found, I observed the more open the technical teams are with disagreement and horizontal discussion of new ideas, the more oriented they are towards the creation of new products and services, fostering a truly culture of engineering innovation. In the design and manufacturing of complex products, it is common for the different engineering disciplines involved (mechanical, electronics, control, manufacture) to negotiate with each other to meet their respective requirements. This is achieved through collaborative design, for which SOLIDWORKS was intended. Rigidly vertical and hierarchical organizations have difficulty assimilating this style of workflow and tools.

The relationship with time and its instrumentalization, as well as the verticality between the client and its suppliers, are also cultural variables that permeate from society towards engineering practice and software commercialization. Client unpunctuality, suspended meets several times, meeting with the supplier in improvised moments and spaces, client commitment to purchase and then extending their payment time, demanding excessive discounts or unagreed post sales services during periods that exceed the scope of the project, all this, are other expressions of the power relations and informality of the Peruvian society.

These local cultural peculiarities, in addition to the particular motivations of the personas found, are factors that directly affect the business and that cannot be detected only through the generic technical-financial segmentation of marketing or quantitative methods.

Based on this train of thought, I found SOLIDWORKS difficult to sell not exactly because of its price, but because of its multi-modular, integrated tools and options, were intended for multidisciplinary, horizontal collaborative teams. As it is not specialized software in a particular engineering discipline, but rather serves as a multipurpose toolbox for 3D engineering, the end designers, who do have to complete very specific tasks, only use a small group of the software options. So, from corporation perspective the software pricing reflects a fair value for all its tools, while clients end up paying the full price even if they underutilize the software with only what they need. This is where the client perception that SOLIDWORKS is expensive comes from.

This also explains why the client tries to compensate for the seemingly expensive purchase with a very demanding personalized technical support, almost as an exclusive consulting. Basically, it is a retaliation or “act of justice” from their point of view: If they have no choice but to purchase SOLIDWORKS at that price, then the VAR must provide an exceptional post-sales service.

From VAR perspective, meeting these post-sales expectations implies an overload in the tasks for the technical team, which in turn affects the delay of all technical and commercial aspects of the business, ultimately affecting sales.

ORGANIZATIONAL IMPACT AND CONCLUSIONS

These results were presented to VAR and LATAM managements. They were received with great curiosity because it was the first time that an investigation of this type was made.

Based on the research, VAR increased its number of commercial meetings, as well as improved its webinars quality and social media engagement. Overall, the discourse shifted from a SOLIDWORKS-centered one to one focused on industry-specific needs and solutions. In fact, VAR management understood they must segment at least nine industry verticals to better understand the needs of the Peruvian industrial market.

These verticals were, from highest to lowest commercial importance: Machine design, metalworking, mold design, cabinets and electrical design, plant and pipe design, air conditioning and refrigeration systems, architecture and civil engineering, electronic design, and design of cosmetic products. From the qualitative research carried out, the first three are those that best fit the ideal of innovation, multidisciplinary teams and collaborative work needed to use SOLIDWORKS solutions.

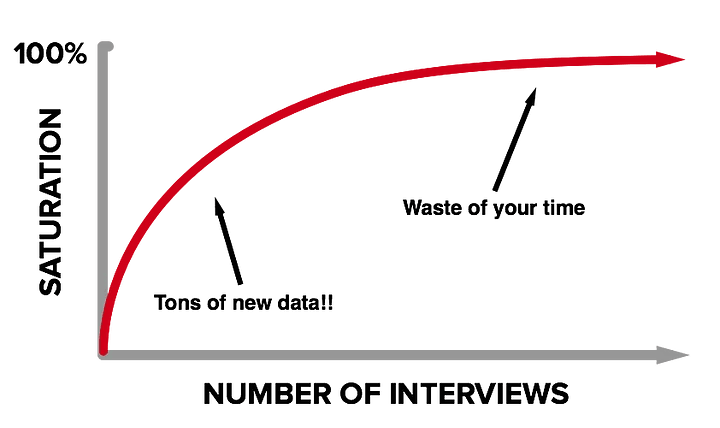

However, there was also resistance in the acceptance of the research results. One of them, as expected, was the “small” sample size (13 interviews). One way to facilitate the understanding of the qualitative research validity during delivery of results is to “translate it” in quantitative terms, especially in organizations with a sales and technical mindset. As interviews were conducted, new and relevant information offered by interviewees becomes less or more difficult to obtain. The saturation point, then, behaves in quantitative terms like an exponential curve whose asymptote represents new information.

By explaining it in this “didactic” way, stakeholders understood that a greater number of interviewees does not indicate additional relevant information, intuitively interpreting that qualitative research is maybe, in its own way, quantitative research. Even so, after discussion of results, researcher was invited to continue conducting more interviews, in order solely to increase the sample a little more.

Resistance to qualitative methods in corporate engineering environments may persist even after beneficiaries understand their methodology. Another doubt or friction was related to the researcher’s experience. VAR management was unsure whether the results presented were from the qualitative methodology applied or if they were rather conclusions drawn from the researcher’s experience in industry.

Paradoxically, the trust placed in applied ethnography methods is, really, the trust placed in the researcher, who earns this credibility if he/she manages to demonstrate that his/her knowledge goes beyond ethnography theory and practice, and that also can understand jargon, dynamics, and corporate objectives (Hanson 2016).

Doubts were dispelled when, in a subsequent research project, I developed for Sales a business tool called Technological Maturity Model, which was based on the qualitative data collected, including techno-cultural factors, to examine whether a prospect or client was technologically mature for the acquisition of SOLIDWORKS or more sophisticated software solutions.

Also, I could observe that if research results are opposed to the interests of the researcher, then stakeholders may conclude that results are indeed the output of the method and not the researcher opinion. This was precisely the case, since, after the research project, one of the strategies necessary to improve sales opportunities was to apply a laborious regionalization of all technical demos, being this task under my responsibility as an Application Engineer.

The experience of working within the VAR enriches the context of the results and analysis. The researcher thus has the possibility of understanding in depth the internal power relations beyond the company organization chart, as well as the dynamics between the company and its clients.

With this knowledge, I can really work from the results found and promote the impact of the research. In this regard, anthropologist Laerke Gry Agger, former Senior UX Researcher at Cabify2, explains that working within the organization, a researcher can be aware of the concerns of the teams, their KPIs, and business problems. It is the only way there is enough context to make a significant impact on the company3, in contrast to researchers hired externally in a consulting role.

The project also shows that beliefs and values system of companies arise from their owners and directors, and then are channeled and refined through Marketing team, whose members define the official narratives (beliefs system) of the organization-tribe. In this sense, the researcher, whether external to the company or working as a member, is also subjected to this system of beliefs and values, having to translate their findings or recommendations into the dominant discourse of the organization.

For instance, since SolidWorks Corp. promotes innovation in each of its speeches and trainings, then they should demonstrate by example that their organization also applies innovative internal processes, such as qualitative research to improve marketing and sales strategies in LATAM industrial sector. This was a way of speaking in the same corporate codes and narrative, taking advantage of them for the application of an in-depth research.

Engineering Culture Versus Idiosyncrasy

Since the personas described in the qualitative research were limited to technical areas, and their tasks are internationally standardized or regulated, it was possible to observe an “engineering culture” (or technical convention) within technical teams in industry in terms of values, goals, motivations, and management, regardless of the country. For LATAM, and from the case studied here, I noticed a general shared culture in industry for design and manufacture engineering.

At the same time, it is possible to deduce that any variability observed across the homogeneous and regulated technical praxis in different countries are due to social or idiosyncratic factors. Comparing these variabilities between technical spaces of each country allow us to notice and highlight the local idiosyncratic factors that permeates through the regulated engineering practice, and then use them for research analysis.

This is because there is no absolute dominance of the technical normative behavior over idiosyncrasy, but rather a local adaptation of these rules, a partial absorption of what is necessary to maintain a normative standard within the company. There is not a complete corporate assimilation that implies a total loss of local identity.

Instead, there is a hierarchy among overlapping value systems within organizations in industrial sector. Thus, idiosyncrasy is the base for any particular organizational culture. And in turn, this organizational culture is the base for the standardized engineering culture.

It was from this analysis that variables such as the horizontal (democratic) discussion of ideas, time management flexibility, and even the local ideal of technical progress were considered as cultural factors that come from idiosyncrasy. Also, they influence the specific technique within industry dynamics, including the relations between suppliers and customers. This is how we can approach to the different assimilation (or rather rejection) of technological solutions (like engineering software) for LATAM countries.

About the Method and Frictions Encountered

The researcher, as a participant observer but mainly as an Application Engineer, was an expert on the technical products offered by the VAR. This was advantageous because it increases the trust in the researcher, facilitates empathy with informants, improves communication and impact on the delivery of results, and allows the development of specific business tools that feed on qualitative data.

But, as has been said, it also fosters doubt (within the VAR) about whether the results are obtained thanks to the researcher experience or by the research method itself. At the same time, this proximity to the work diminishes the anthropological distance the researcher must have with respect to the context observations. In this sense, the applied methodology and frictions encountered deserve a final reflection.

Considering that an engineering software is a tool at the end, an ideal ethnographic method would have been a total immersion within client companies, to directly observe how the implementation and use of the software on site, as well as taking notes on the daily work related with other software and its suppliers. However, this poses enormous difficulties given the privacy policies of companies in the industrial sector. For this reason, in addition to in-depth interviews, software usability tests are good alternatives for these purposes.

Even so, research within companies, especially as participant observer, allows the discovery of “sincerity spaces.” These are physical and/or digital spaces configured within the business dynamics, with the advantage that they are not rigidly subject to corporate norms o supervised, encouraging a free expression of ideas and behaviors of employees.

In the industrial sector, some examples of these spaces of sincerity are the company’s transport for employees, the company canteen, an alternative WhatsApp groups to the official company channels, informal conversations during work trips, fieldwork without supervisors, corporate parties and special events4, etc.

As it was explained about the inherent resistances of the corporate interactions between suppliers and customers, the discovery of these opportunities for “relief” or spontaneity is very important for the development of B2B business; even more for industrial sector, characterized by private spaces of very limited access. In this way, suppliers (and researchers) can understand the real motivators and coercions behind the industrial client’s needs in greater depth.

In fact, one way to identify a space of sincerity (or conversely, an insincere one) is through the informant discourse. As Moeran (2016) points out, if the discourse is repetitive across different informants and coincides with the institutional or normative narrative of the company, it is likely that in that specific place there is not freedom or the sincerity necessary to extract qualitative data.

A direct corollary of this ideas is that, leaving everything corporate-normative behind, the informants’ behavior within sincerity spaces is the behavior that most express the idiosyncratic factors within industrial environments.

Thus, we can notice how these insights help us not only to understand and mitigate the frictions inherent in conducting qualitative research in these spaces—so technical and isolated that they are not aware of the ethnographic applications on private sector—but also help us manage the frictions between the market approach of suppliers (in this case, SolidWorks Corp and the VAR.) and the different local realities of clients.

In addition, it was shown that it is possible to find a deeper segmentation based on personas than the usual industry marketing segmentation. By making strategic decisions based on these new profiles, and by obtaining from them positive results through improved marketing content and sales tools, a real impact was generated too within the VAR organizational culture. In this sense, two more frictions were dispelled: the resistance to test new ways of understanding final users and verticals, and the doubts about whether an engineer can be a legit ethnographer.

Finally, having said all the above, I believe the most suitable qualitative research methods to create knowledge from B2B industrial companies would be participant observation, semi-structured interviews and analytical autoethnography (Colobrans 2018), which require for the researcher to carry out prolonged immersion working within the organization with the advantage to gather deeper insights from the cultural context of these technically regulated spaces.

I personally hope the contributions of this case study encourage more ethnographic projects in the industrial sector, especially in Latin America. As this study demonstrated, this research is not only possible, but necessary for the best development of engineering software solutions as much as for the satisfaction of end users in industry, whose local needs would finally be heard and addressed.

ABOUT THE AUTHOR

Salvador Suniaga (1984) is a mechanical engineer and ethnographer of the Latin American industrial sector, specialist in engineering software solutions. He has leveraged his experience in technology product & services companies to create valuable knowledge from private sector to academia. salvador@solidindustry.com

NOTES

1. The author of this case study does not represent the official position of the employer. However, it was not easy to support these initiatives. VAR leaders did not know about qualitative research methodologies, and even after a long and constant process of internal disclosure and updating about them, these methodologies were considered typical of foreign organizations, especially from developed countries. That is, in-depth research was considered as an advanced and exotic solution that had no application in local companies. From their perspective, no one in Peruvian industry, even in LATAM, was doing this type of applied research.

2. Technology and mobility company that offers transportation services through a mobile application.

3. Gry Agger comments on this as a professional guest in a recorded lesson of the Master of Business Anthropology of UMANYX, in the module Working in Business Anthropology. Year 2020.

4. In fact, this is intuited by suppliers marketing teams when they organize talks or presential events: in addition to capture business opportunities, they know prospects and customers in these spaces are particularly more spontaneous in sharing information about the dynamics of their work, needs and expectations.

REFERENCES CITED

Colobrans, Jordi. 2018. “Applications of the Autoethnographic Method in Technoanthropology Projects”. Culture, Design and Technology. Essays of Techno-Anthropology. M. Matus, J. Colobrans, and A. Serra, Eds. First edition. Mexico. Colegio de la Frontera Norte.

Foucault, Michel. [1975] 2022. Discipline and Punish. The Birth of the Prison. Translated by Aurelio Garzón del Camino. First edition. Argentina: Siglo Veintiuno Editores.

Goffman, Erving. 1959. The Presentation of Self in Everyday Life. First edition. New York, United States: Random House.

Hanson, Natalie. 2016. “Recognizing Agile”. Handbook of Anthropology in Business. R. Denny and P. Sunderland, Eds. New York: Routledge.

Isaacs, Ellen. 2016. “The Value of Rapid Ethnography”. Advancing Ethnography in Corporate Environments. Challenges and Emerging Opportunities. B. Jordan, Ed. New York: Routledge.

Moeran, Brian. 2016. “Theorizing Business and Anthropology”. Handbook of Anthropology in Business. R. Denny and P. Sunderland, Eds. New York: Routledge.

Sagasti, Francisco. 2003. The System of Technological Innovation in Peru. Background, Situation and Prospects. Lima: Agenda Peru.

Seaman, Mitchel. 2015. “The Right Number of User Interviews”. In https://medium.com/@mitchelseaman/the-right-number-of-user-interviews-de11c7815d9. Accessed October 7, 2023.Zapata, Gerardo and Hernández. 2017. The Company: Design, Structures, Proceedings and Organizational Forms. Third edition. Fondo Editorial UCLA. Barquisimeto.