Since the 90’s, one of ethnography’s values has been about the reduction in the risk of developing new products and services by providing contextual information about people’s lives. This model is breaking down. Ethnography can continue to provide value in the new environment by enabling the corporation to be agile. We need to: (1) identify flux in social-technological fabric; (2) engage in the characterization of the business ecosystems to understand order; and (3) be a catalyst with rapid deep dives. Together we call it a FOC approach (flux, order, catalyst).

INTRODUCTION: RIGHT KNOWLEDGE, WRONG TIME

It is cold and snowy Tuesday morning in December, 7:30AM to be precise. I hate getting up. I love being in bed, snuggled warmly under some covers. Dorms are either too hot or too cold, and my part of the dorm is too cold. I had been up to 4AM studying for an American Short Story Literature class. I’m headed off to the course final in the Academic Center room 203. Having been up most of the night, I’m feeling really confident, despite the early morning hour. I actually spent some of the weekend re-reading all the authors and there is good overlap with a course I had freshman year on American Modern Literature. I also practiced answering essay questions because thinking quickly is not really my forte. I arrive at the room 10 minutes early and take a seat midway back in the room. I can just feel I’m going to nail it. As time ticks by I notice the room is not filling. It is 8AM and no one is in the room. I walk around the hall looking for someone but it is too early and no one is around. I walk up the next floor to the Literature department and ask the admin about the location for the American Short Story course. She looks it up and says, “Yes it is in AC203 but it is tomorrow morning.” I rack my brain for what is wrong. I dig into my backpack and come up with my rumpled exams schedule. I’m in the wrong place at the wrong time – I’m supposed to be in my North American Geology final on the 3rd floor of Middleton Science Hall. I’m now 30 minutes late and haven’t studied for geology yet!

Unfortunately, it is our contention, that what happened to one of the authors during finals week years ago is also happening to ethnographic praxis in industry today – we are well prepared for a particular kind of work but not the right one, not the one we need to do to enable our organizations and clients to thrive at this time. The frame for the work has shifted. In particular, the guiding model of most industry work, regardless of theoretical approach or particular methodology or area of research or means of representation has been focused on reducing the probability of failure for a product, service or strategy. We will explain the model of value for our work under which we have been working for the past 15+ years, and how business conditions today offer new challenges that make that model less valuable. A complicated business environment framed previous ethnographic work, whereas complexity frames today’s business environment. This new complex business environment drives ethnography to focus on values associated with a higher velocity of the market and greater complexity in the market. These market conditions are antithetical to the assumptions of the market under which ethnographic praxis has thrived. The new conditions, however, do offer new opportunities for ethnography by enabling agility for organizations. We can enter an era of Ethnographic Praxis 2.0.

THE BUT MODEL: WHERE WE’VE COME FROM

The foundation of modern ethnographic practice was laid out in the 90s. Wasson (2000) highlights the rise of the field, particularly via E-lab. Wasson demonstrated that the early successes were about providing deep contextual information about people and their practices. It was this deep knowledge that enabled the spread of ethnographic practice. More recent edited volumes by Jordan (2012) and Cefkin (2010) and a “how to” book by Crabtree et al. (2012) highlight the many field sites and businesses where ethnographic practice has thrived and some growing tensions in the field. Looking over the breadth of the field from these books, one would be thrilled by the growth of ethnography used in business. One of the early papers outlining the area of Design Anthropology (Salvador 1999), laid out the importance of ethnographic work for new product development. This is an important piece for us because it pointed to the role in product development cycle that ethnography could have; Ethnographers could help corporations by reducing the probability of failure. The way ethnography could do this was by providing a contextual and emic understanding of people and their practices. The importance of people was that they had become an integral part of what has come to be known as the BUT model. BUT stands for Business, Users and Technology. The model hypothesized that the greatest business opportunity lay at the intersection of BUT. This required not only the usual deep understanding of technologies and business, but also a “deep” understanding of people. Further, once an area (product, service or strategy) had been identified, either in advance or out of research, then further research on people (the U) would enable proper tailoring of the product, service or strategy so that it would be more likely not to be wrong. The research reduced the uncertainty associated with creating a new product or service. Whereas a deep understanding of people was not an integral part of doing business before, it was now integral to a model that was driving actions. While business and technology (or product developers) had established ways of reducing uncertainty, ethnography introduced new and important elements into the mix: people and contexts. The reason that ethnography could reduce uncertainty was because the largest unknown was the user, not the business environment or the technology. Further, the assumption was that unknowns were “known unknowns”, that is businesses knew what they needed to understand in order to succeed. They were in a complicated business environment (Snowden 2007). The business environment was based in cause and effect as being relatively predictable with proper research and analysis.

FIGURE 1. BUT model of product development

BUT model assumptions and ethnographic value

The original BUT model that enabled ethnographic praxis in industry to flourish these last 20 years made certain assumptions. Ethnography was interpreted primarily as a way of explaining detailed lives of people. These descriptions often consisted of two parts (Salvador 1999): (1) in situ research to describe the context where a product’s use was or was imagined to be and (2) an emic point of view; the ethnographer could bring back a narratives from the field, ideally people’s own words and actions captured, providing the target user or consumer’s perception (as point of balance to the corporation’s perceptions). Of course there were other foundational parts of the design anthropological approach, like being multi-sited, holistic and generative, though these didn’t have the same weight in terms of value for BUT model. In practice, the result has been to understand contexts and ensure emic voices are heard. These two aspects of context and having the people’s point of view, were crucial in order for the BUT model to succeed at reducing uncertainty around “users”.

The BUT model itself has some assumption that enabled ethnography to thrive with it. First, it assumed that the “market environment” changed at a relatively steady rate. Radical changes or a great deal of volatility in the market were not part of new product development model. Second, the model assumed that the rate was slow enough that classic measures of the market, e.g., segmentation surveys or pricing sensitivity studies, adequately captured a meaningful and relevant state of that market not only at the time of measurement, but at the time the new product would be introduced. Third, as unpredictable as markets for new products are, it assumed that all variables with any likelihood of impacting the new product were known. Therefore, the role of ethnography was to more precisely identify the mean – the product or service that the greatest number of people would choose within the complicated but stable market system.

The assumption in the model is that a company will only take to market ‘a’ product or service, and so finding ‘the’ product or service attractive (or at least good enough/acceptable) to the greatest number of people was a benefit. Now small-scale manufacturing, “makers”, digitization, and so on, allow the tails of the distribution of customer needs to be addressed. So ‘a’ product or service is no longer sufficient. This phenomenon extends from manufacturing (maker movement), to participation (data, virtual) as well as to funding (Kickstarter). More and more companies are finding it necessary to move away from a single product/service strategy to an experimental process (Intuit, Lean Startup).

In fact, one exception to prove the rule is the notion of the “strategic inflection point” (Grove 1999). Grove recognized that markets do indeed change, but that these changes are punctuated moments in time associated with a significant change in the basis or bases of competition. These punctuated moments of disequilibrium can be specifically identified and isolated is demonstrable by these first three assumptions: (1) Of course markets change, but (2) those changes are either slow enough or only occasionally punctuated with significant change, (3) that changes are the exception, rather than the norm.

The main contribution of ethnographic work in this milieu was specifically to qualify social and cultural variables (as opposed to the market variables) that would contribute the acceptance or rejection of a particular product. The ethnographic work would delve deeply into the context and mindset of the people being studied. Ethnography then became a key to unlocking the “U” for putting together the success puzzle in the BUT model.

There is, however, a fourth assumption of this old model – cultural values and practices change slower than the market systems emerging from and riding on them. Even though we recognize cultural values and practices do change, the evidence suggested they change slowly with time – and so slowly as to be effectively and essentially stable and static with respect to new product development. In short, social-cultural change wasn’t assumed to happen in a normal product development cycle. We will re-examine these assumptions in terms of the world today.

THE NEW WORLD CHANGES: FASTER & MORE COMPLEX

We find the assumptions of the BUT model no longer hold as usefully for a large sectors of business, especially those affected by the increase in digitization. We see this as a shift in the market system that is occurring – moving from a complicated but predictable market to a complex market system ( Basole et al. forthcoming). The market as a complex system posits that constituents are interconnected through a complex, global network of relationships, allowing them to share risks, have access to synergistic knowledge but no entity can know the entire system (Basole et al 2012). Knowledge is emergent and cause and effect can only be known after the fact (Snowden 2005)

From our perspective, there are three reasons the assumptions no longer hold: There is an entirely new class of digital assets that has increased the velocity of the market; the result of the last 50 years is an increasingly available range of “commodity” technology “parts” including access to distribution and manufacturing systems effectively increasing the complexity of the market as well as cultural values “in flux” as a result of the digitization in society. The result of these changes is fundamentally changing the structure and dynamics of at least today’s high tech markets, as well as the role of ethnographic research. We expand these themes below.

First, we find significant changes in the “inventory of things” available to us. “Things” are increasingly digital – that is, things that use to be physical and, in economic terms, rival, are now digital and non-rival, meaning that you having a recording of Bach’s Brandenburg Concertos does not limit someone else having such a copy. As is clear to the reader, many things are becoming digital, including but not limited to: music, movies, letters, advertising, identity, friendships, conversations, therapy, medical records, educational materials, games, money, reputation, dating, credit, banking, knowledge, maps, languages, work, politics, government, voting, journalism, photos, revolutions, justice, parking spaces, hotel rooms, etc. What’s important is not just that these formerly physical “things” are now digital, but that by being digital, they are qualitatively different: They can be acted on, shared, stored, transformed, etc., in ways previously impossible and therefore, collectively form a new class of digital assets.

Second, whereas access to high technology – that is, digital components – was previously the province of elites of various stripes, increasingly digital components are inexpensive, diverse and plentiful. In addition, access to manufacturing, distribution and sales is also increasingly easy and affordable. While one might think about the possibilities of 3D printing, even today, small scale manufacturing can be done through China from anywhere in the world. Further, the knowledge and capacity to design new products based on digital components is also substantially easier and more plentiful with hundreds of thousands of engineers graduating each year in a much wider variety of countries as well as increasing access to advanced knowledge through various forms of connected education models. The result is that there is essentially a glut of parts, access to a variety of manufacturing and distribution and the skills and capacity.

Third, markets are evolving quickly. Whereas BUT era companies were focused primarily on “a” product, now the evolution and shape of the market are crucial to a company’s new offerings. There have been a number of companies that have remained in place but the market has shifted. Their inaction in pursuing appropriate market directions, while satisfying business, user and technology demands, has left them in a weaker position.

Finally, ethnographically, we’re detecting flux in long standing cultural values, such as with ownership, accountability, social participation, etc. That is, what it means to “own” something is changing as a result of the first two shifts. This creates the possibility of new social roles, such as the “everyday entrepreneur”, where “everyday” refers to the concept of the “journeyman” [sic], or “amateur”, even if it’s at high levels of skill. Or, what it means to hold people and institutions accountable is also changing, creating the new social roles of “scrutinizer” and “scrutinized”. The notion of “cultural flux” as outlined here is itself a new way to look at ethnographic praxis, and is discussed more fully elsewhere (Bezaitis 2010).

In sum, our business environment has become more complex (not just more complicated) in the past 15 years. Previously the order that emerged – the system of exchange and organization of players in the industry (Porter 1998) – was slower to change and more easily understood with commensurate methods of measurement. Today the factors we’ve discussed above result in more interaction of parts of the system, combining more rapidly and added together with cultural flux create a system that is not comprehensible by traditional notions of order (e.g., markets) and they are more difficult to study/understand. The role of ethnography must adapt to articulate how products and services exist within such an ordered system to describing how the system itself might change (what’s in flux and what new order might emerge) and how the market might be influenced by a company’s actions. In this environment the factors of the BUT model give way to an ethnographic focus on Flux, Order and Catalysts (FOC) in the market ecosystem.

New context for ethnography in practice 2.0

Together, these three shifts: the creation of a new class of digital assets, the common availability of commodity parts and skills and the flux of cultural values creates a foundation a very different market system, which itself requires different approaches to comprehend and address the market. We’ve diagrammed this out in Figure 2. The bottom axis is the Velocity of the Market (Vm); on the left, the Velocity of the Organization (Vo); and on the right, the Complexity of the System (Cs). Cs is defined as the total possibility state space. That is, given cultural flux, commodity parts, and digital assets, there are a vastly larger number of combinatorial possibilities of technological means to reach the market and market acceptance; thus, the Cs is a measure of the total potential bases of competition in the market. Vm is defined as the rate of change of these bases of competition, that is, the activity of engagement in the possibility space. Finally, the Vo is the measure of the organizations ability to keep pace with the velocity of the market with respect to the changes in bases of competition. (Of course, “velocity” is a measure of change over time, so time is implicitly accommodated in this figure.)

FIGURE 2. Emergent Market System: Velocity of Market, Velocity of the Organization & Complexity of Market System

Vo has two components, how quickly it can test a specific basis of competition, and how broadly it can probe a complex space of potential and diverse bases of competition, both need reconciliation to find a position of stability or order in the ecosystem. Smaller companies require positions of less order – needing only suppliers and customers (Porter 1998). Larger companies, to maintain larger revenues, require positions of more order to which many companies and bases of competition can orient. Maintaining a position of order is a challenge because it is expensive and risky to invest too broadly or too quickly. To avoid the risk, companies adopt a wait and see strategy – to see what market order or winners emerge. The downside of a waiting strategy is it often becomes too late or too expensive to buy ones way into a new market once the order has mostly emerged with entrenched platform providers in place. Ethnography can help narrow the huge possibility states of potential new orders or market platform winners to a few that are consistent with flux. Further it can guide an organization where to probe or catalyze with early action and investment to optimize the velocity and diversity investment equation.

In Figure 2, we’ve identified the “perfect” or “ideal” position, which is the dashed dark diagonal line, which we assert is the Vo perfectly matched to the Vm and vice versa. We also identified the dashed diagonal line slightly above the dark one, which indicated the “desired” state of any organization to be “ahead” of the market by just enough to gain competitive advantage. Ideally, this is the optimal position for most companies.

Finally, we must consider the four quadrants, which reflect the relationship of Vo, Vm and Cs. The upper left and lower right quadrants represent less of an opportunity space, so we cover them quickly here: The upper left represents an organization whose capacity for addressing the market (Vo) exceeds the rate at which the bases of competition are changing, even though there is high system complexity (Cs). An example of this would be electronic medical records. In the lower right, we have the opposite, high Vm, low Vo, but low system complexity. An example here would be the establishment of a brand new basis of competition that immediately supplants a prior one, and thus, prior organizations. The shift from iron lungs to the polio vaccine is a good example of the clear advantage in a system of little complexity of market solutions.

In the lower left quadrant, we have low Cs, low Vm and low Vo. This quadrant most closely aligns to the “old” BUT model of uncertainty reduction. In this quadrant, the system complexity is manageable, bases of competition are changing slowly enough that classic methods can be used to measure the market activity, detect trends, and plot not only possible, but probably future states with some confidence such that the success of a product release can be somewhat reasonably ascertained, that is, all else being equal. Moreover, organizations operating in this quadrant have the capacity to move with or, if they are really good, be slightly ahead of the market. Ethnography was able to provide the necessary information to enable companies to at least keep pace, and usually be a step ahead of the market. Ethnographic research was the competitive advantage.

However, based on our argument of cultural flux, new digital assets, and new commodity capabilities creating a more complex market system, the upper right quadrant is where all the action is; this represents the “new” model” under which we are operating in a more digital world to develop product, services and create strategies. Our current and old ways of delivering value to organizations in the system need to change. With high Cs, and concomitantly high Vm, we see the bases of competition changing rapidly. Organizations and methods need to adapt appropriately. We will explore this quadrant more fully to understand the system and implications for ethnography.

The high complexity/velocity quadrant

First of all, the system complexity is high – there are more and new digital assets, a commodification of everything and the willingness to apply it. Second, we see a large measure of “disorder” in the system as a result. New products are offered almost daily, from small, medium and large companies, through a variety of market vectors introducing new bases of competition. Each introduction has some probability of bringing a measure of order to the system as other participants orient their efforts to the new introduction. With each new introduction and orientation (or lack of it), organizations at pace with the market (Vo matches Vm) adapt with improvements, changes and/or cancelations.

Figure 3 represents the look and shape of launching new products into a complex system. The system, unlike the BUT or complicated market, presents a very different challenge. The path to success is not a straightforward linear one. It is not a matter of defining the market. All the parts are moving.

The goal of any organization is to reduce the viable/likely options in the possibility space by introducing order to the system. The question is, therefore, how to introduce order into the system, not reduce uncertainty. Uncertainty will remain. This is a crucial distinction; reducing uncertainty suggests understanding the system, per se, prior to launching the product. It suggests a linear, stepwise process. We contend, however, the system is now too complex for a prior comprehension and thus the product launch is itself an experiment about order or arbiter of order. The product launch becomes an indicator of the probability of creating order in the system, even as the system complexity increases with each introduction. Creating order in the system means that at least some of the system elements orient to/around/with the new product/service introduction. Failure to get other parts of the market system to order around the product/service will mean product/service failure. The implication of this is, small companies – or even everyday entrepreneurs – only need to create a relatively small degree of order to “survive” in this system, whereas large companies must create a relatively large degree of order around their product/service to “survive”. It is unsurprising then that Kickstarter now funds about one quarter of start-up activity in Silicon Valley and growing – it enables small introductions to the system that require little to orient toward these products and services. In other words, it is much easier to have small successes, of others orienting toward you, in a complex market than large ones.

IMPLICATIONS FOR ETHNOGRAPHIC PRACTICE

A change to a complex market system and adapting to these new conditions changes ethnographic praxis. It has to. No longer is it adequate to “understand what it’s like to be a family in Northern Spain”, but rather, we must understand the dynamics of the most salient cultural values and practices of networks that may include people in Northern Spain, but also many others. This change in scope and content of our research must be extended to enable companies we support to take advantage of the dynamics in the system. It means understanding what are the key underlying elements in a complex system, which parts are in flux, what are possible opportunities to create order and what catalysts can be introduced to test the system.

Further, more than ever, ethnographic praxis needs to account for change over time, not stability in time. Change is a way into the dynamics of social-cultural-technologic systems. Change becomes not only helpful in knowing the key elements but also in understanding the property and relationships of these elements. How are they working or not working in the system. The dynamics of the change are what we need to capture, and not an imagined static state. Understanding which and how to change key elements, as was described by Bezaitis (2011) around ownership, provides knowledge to enable an organization to interact with the complexity of the system. We must tap into these areas causing change for the market order, to understand what we’ve described as flux areas, in order to provide organizational advantage.

Finally, description must be thick, in Geertz’s (1973) interpretation of the word thick, not thick as in dense. Thick description specifies the conceptual structures and web of meanings, not a factual account with lots of detail. They are models of and models for action. More than ever, the goal of our work is not to describe what is, but what may be (Bezaitis 2011; Galloway et al. 2011; Bleeker 2009). While being generative was a goal of the old design anthropology, it is even more complicated now; what may be may be multiple futures. There is no future perfect. We create multiple potential paths.

These changes diverge from what became the hallmarks of ethnographic work in industry: (1) A focus on context (the home, the car, the office, the kitchen, the street, etc.) and being in the context to conduct the work. In part, some of this work grew out of a response to products only being tested in labs, far from the environment they would actually be used in. In part, it was a response to concretizing knowledge from surveys. Whatever the reason, it lead to fruitful explorations of a kind of knowledge that companies were not getting that would help them reduce the risk of product failure. Although working in situ remains important, the goal is no longer to describe or analyze the context but to understand the dynamic forces acting in these contexts. Studying 20 Indian homes may or may not help understand fundamental shifts, the social-cultural-technological flux involving around the nature and practices of “the family” or the positioning of a new service for the home; (2) A second characteristic was a focus on the emic view – to tell the insider story or letting the insiders voice be heard (the Indian mother, the hip Japanese teenager, the senior Irish woman living at home, etc.). Although voice of the people is important as a part of the information to providing avenues into market order, it is not necessarily as crucial as in the past. It will might not be the case that an emic view will provide a direct way to create order, tells us what exactly what is in flux, or provide opportunities to launch catalysts into the market. The emic view, though, continues to be an important input into understanding the dynamics of the system; and, (3) being generative, not merely descriptive. This last point remains relatively important, with a qualifying shift – instead of creating one direction, representing multiple future paths. Ethnographic must enable paths into the market that can enable probing and measured responses to understand where order and stabilization can occur in the constantly emerging market space.

SUGGESTIVE DIRECTIONS ETHNOGRAPHIC PRACTICE

Ethnography cannot continue to do the same old thing and be vital to a complex market place. Ethnography can continue on as a part of any research program, but retaining the control point position we had in the last two decades will not be sustainable without changes to what we do. Ethnography can play a key role in knowing the systems and enabling agility on the part of the organization in a rapidly changing market that is part of a complex system. There are three immediate implications for this new model as to how ethnography should happened in a corporate environment. First, there is an increased need to have constant on-going ethnography to monitor the social-technological changes occurring. Knowledge, not just methods, is important. Monitoring the social world, in particular becomes important in order to understand what is normative, what is changing, and what might be perceived as an opportunity for stabilization and order. Second, we need to be active participants in returning business system information, not just consumer culture information. While BUT assumed a separation between business, users and technology, in a complex adaptive system, these distinctions become blurred. What ethnography was to design in the 90’s needs to be what ethnography is to business going forward. Finally, as ethnography takes on new roles, new types of teams need to be formed. While ethnographers have become comfortable working with designers, there are whole new roles and specialties that ethnographic teams need to employ.

Eco-system ethnographic studies

Ethnography can play a key role in knowing the systems and enabling agility on the part of the organization in a rapidly changing market that is part of a complex system. There are three immediate implications for this new model as to how ethnography should happened in a corporate environment. First, there is an increased need to have constant on-going ethnography to monitor the social-technological changes occurring. Knowledge, not just methods, is important. Monitoring the social world, in particular becomes important in order to understand what is normative, what is changing, and what might be perceived as an opportunity for stabilization.

We will briefly explore three separate ways some current ethnographic organizations are enabling the ethnographic stalwart of longitudinal or in-depth work to happen. We call these “my people”, “ethno-mining” and “topics” approaches. The examples are meant as illustrative of kinds of approaches.

We look forward to upcoming EPICs for papers that reveal new successful approaches in a complex market environment. The examples here are not endorsements of any of these organizations, the quality of their work or the sustainability of their business practices. We are, however, are suggesting that sustained longitudinal research, rather than frequent movements between topics and people (e.g., domestic help in one project, followed by a project on Chinese youth and cars in another), might not work as well in understanding changes and opportunities for order in a system. We look to these ethnographic research projects as examples of what would support the value of ethnography in the high Vm/Cs realm.

The “My People” model

One approach to ethnography that shows promise is to be deeply engaged, highly specialized, and focus on a particular area of specialty. One example in operation today is China Youthology (http://chinayouthology.com). China Youthology studies one thing – Chinese youth. What is interesting in their approach is the on going monitoring of a particular population segment in a particular geography. China Youthology continuously runs ethnographic explorations with China’s youth. These are classical ethnographic approaches in that they include interacting with the youth in a variety of contexts, on and off line. They are monitoring what youth are doing, how they are acting what they are saying. Further, they are not just distant white coat observers, but also active in supporting and sponsoring youth events in the arts and entertainment. These kinds of activities provide the opportunity for insight not only about youth, but also about companies directly interacting with youth in large business eco systems like technology, arts, entertainment, consumables and media.

The advantages of this approach for our model are a through understanding of the system features relations to that population. China Youthology can understand the macro characteristics of the system and what have been the flux points in the system in the past. The research can differentiate what changes that have really changed underlying social-cultural structures and what are more surface changes. China Youthology has a deep understanding of the people, their values and practices and knows the rationale behind past successes and failures of businesses interacting with the population, and recognizes the emergent nature of youth’s relationship to the market. They are ready to identify and act upon flux areas as they emerge. This is not the only way to do longitudinal ethnographic work with “a people”. Ichikawa (2012) outlined how longitudinal ethnography and collaborative design in a village gave insight not only into the village but Japanese culture. Likewise, Nafus (2013) two year long research with the virtual Quantified Self community, demonstrates that sponsoring community events, conducting collaborative design and being embedded in the community can help ethnographers know not just about the QS community, but also areas of flux in wider American culture. Clearly, there are many ways to do a classic style ethnography with “my people”, following them over time to gain a depth of knowledge about potential flux opportunities.

Big data, behavioral tracking approaches and ethno-mining

Given that the digital is a contributor to the disruption, it is also a source for ethnography to remain vital. We see potential in using digital data to enable ethnography to understand the on-going dynamics of the system. In particular, we’ve seen in the works of people like anderson (2009), boyd (forthcoming), Churchill (2008), Gray (2012) and Patel (2010) are just a few examples of how longitudinal tracking studies reveal larger patterns in the system, and points of disjuncture or flux. EPIC has been a venue that has been open for exploring digital behavioral data not as a threat, but as an important tool in the ethnographer’s tool kit. The approach has similar advantages to the “my people” approach though with a different target population, whether that be on-line communities, users of particular devices, or users of an on-line service. Ethnographically informed big behavioral data enables the ability to notice changes in social and cultural practices – emergent patterns in the system.

Punctuation points – With a high complex and a very dynamic system, it is important to be able to make frequent probes, or tests based on hypothesis about the opportunities for an organization. The “my people” approach or the ethno-mining approach enable a baseline of knowledge of the system. With that kind of knowledge, it is relatively easier to create entry points for these punctuation probes. Nafus (2013) has been conducting these types of probes with the Quantified Self community. These have sometimes occurred in via a regular series of meetings with community members and researchers called “Co-labs.” Further, the QS research project is adding a software app to explore community understanding of areas of interest that might arise, like data sharing, which could impact Intel’s research project around personal data. Another research activity related to this kind of work, perhaps, has been some of the activities of living labs. Although there are many aspects to living labs (cf http://livinglabs.mit.edu) , the key salient feature for us here is assessing new products and services in real life situations, especially the social and market aspects. At this time, we aren’t aware of many other practices in this area, however, these in theory could be similar in structure too much of the work done today with ethnographic practice in industry. Quick studies, done whenever needed, on whatever topic is relevant. The big switch from today’s practices would be the focus. Rather, than a constant exploration of the broad unknown, research would need to target particular hypothesis around social-cultural flux, dynamics of the market or potential ways to create order in the market. These ethnographic explorations are examining both the market and social conditions.

Topics model – Long durations of time is not the only way to understand the breadth and on-going system dynamics. Radka (2011) explained how Claro conducted a consortium research project around ownership. The paper briefly describes the advantages of consortium work in terms of taking on a large question at a reasonable cost in a timely manner. For the purpose of the new design ethnography, a key value in this type of work is the ability to do a series of topic related projects. Following these topics in-depth, doing both ethnographic and business ecosystem work, provides a sense of the system landscape, as well as, what fundamentals are in flux. The model maps well to the kind of product development we envisioned in Figure 3. The ownership consortium project lead to new work on value networks, where another aspect of traditional roles was changing and new forms of value were being created. The value network research then lead to research about the personal data economy. If you recall Figure 3, ownership was entry point into the system. The next series of research projects were pursuing relationships to that entry point to understand where products/services could be to get others to orient around them. The topics approach enables the ability to pursue topical relationships in a system to understand which parts of the system are malleable for stabilization or disruption.

Ethno-analytics

In the old BUT model, ethnography was primarily focused on the detailed understanding of people and their contexts. With a new complex market model with a complex Cs and increased velocity Vm in which ethnography needs to add value, there are new opportunities for us. A key aspect is contributing to understanding the market place, not just people and their contexts. We have conducted two different experiments utilizing ethnography to provide insight for our organization to take action in the market of the emerging data economy. We are going to use examples from our recent exploration into data economy. The space of interest around the data economy emerged from flux work around changes ownership, everyday entrepreneurships, new forms of participation, changes brought about mobility and the rise of new sensing technologies. We developed a vision of an emergent data economy, in which individual’s data circulates, combines with other data (public and private), and returns economic or participatory value. The premise was on an individual’s ability to access and use their personal data.

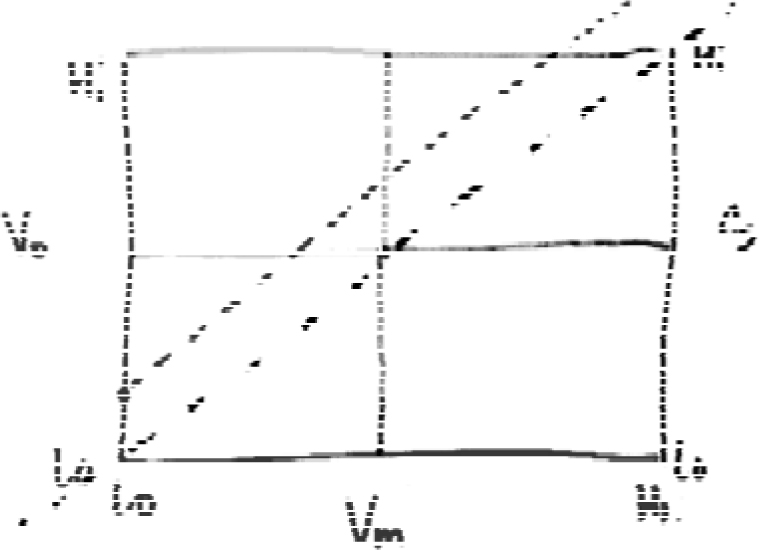

Eco-system patterns – Ethnography provided a broad understanding of the space for a data economy. Still, we needed market data to determine if there was evidence of disruption of market opportunities. We needed evidence to suggest that “data” is becoming the fundamental driver of the digital ecosystem (vs. traditional drivers of device performance, power, form factor, etc.). Partnering with QUID (www.quid.com), we used the criteria for data economy model from ethnographic data, to run a big data analysis against publically available information about companies. What we were able to create was a history of the rise of a data economy from 2000 until the time of the study in 2011. We were able to map the dynamics and relationships in the business ecosystem that could form a data economy. The analysis revealed that by 2011, private investment in data companies exceeded investment in traditional computing companies (See Figure 4). The companies in the circle were entirely new since 2000. Furthermore, on its current trajectory, other “computing companies”, though perhaps remaining profitable, may lose “centrality/ influence” in the broad high tech industry unless they secure strategic positions in the emerging data economy. Figure 4 represents a historical snapshot of the ecosystem in 2011. The digital ecosystem, as traditional computing companies (semiconductors, networking, storage, etc. represented by darker dots) are repositioned in the global digital ecosystem network as data-centric companies (lighter dots, named ‘vibrant data’ companies) are funded. The ecosystem mapping provided a big data and visual analysis that showed an opportunity space, as well as, some key clusters that could form the basis of gaining footholds of control or strategic influence in an emerging data economy. The main point here is rather than traditional representations and descriptions being used to create something like “personas”, the ethnographic content is used to explore the market dynamics.

Figure 4. Ethno eco system analysis

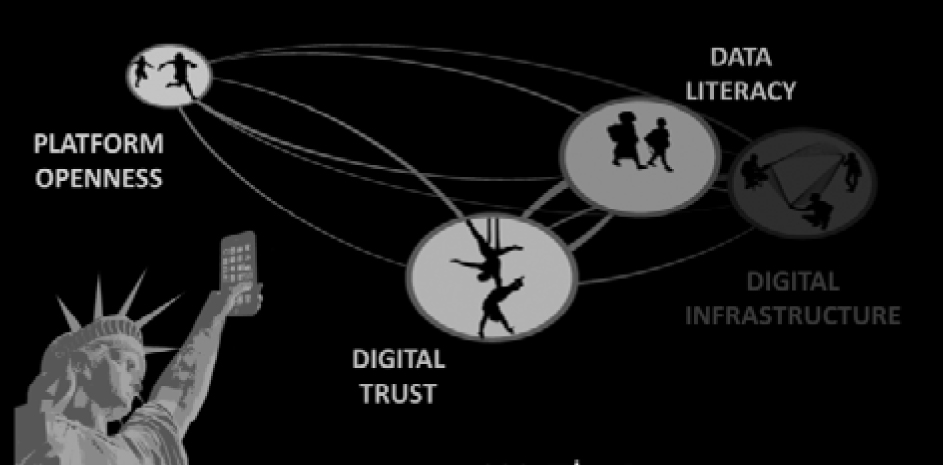

Eco-system simplicity from complexity – Although we identified the data economy as a potential market because of social-cultural values in flux, we needed to understand the potential of the space. How can a disruption present opportunities for a company (e.g., Intel) to provide the technologies and platforms that empower individuals to benefit from the secure circulation of data, creating and exchanging value to the benefit of themselves and their communities. To narrow the scope of the huge opportunity space, we engaged in an expert sourcing (like crowd sourcing but with a very select crowd of experts) of the complex network of factors that could lead to a data economy (www.WeTheData.org). The analysis itself was not done in the typical ethnographic style, but through an open crowd-sourcing process. Ethnography, however, was crucial to the process. It was through ethnography that we could identify the 90 variables for analysis. From the 90 variables, network analysis showed a cluster of 22 factors that might be considered “leverage points” or potential points of order in a system – these are the catalysts in the market on which we could focus our attention, either by developing technologies for the marketplace, enabling an ecosystem of developers, or other means. Collectively these factors pointed to four broad “challenge areas” or “design criteria” that would have the highest likelihood of catalyzing a new data economy: Digital Trust, Data Literacy, Platform Openness, and Digital Infrastructure (see Figure 5). These serve as a foundation for potential actions internally as well as externally. Further, by making the research and analysis part of an open innovation system, Intel has been able to catalyze and direct fellow travelers and entrepreneurs into the market in a way that furthers Intel’s path to successful entry. Ethnography can directly contribute to creating market directions for organizations, just like we have in the past toward product development. The techniques are new and different, but ethnography’s ability to contribute value in a market environment like we described of fast Vm and high Cs.

FIGURE 5. Key factors that emerged from network analysis: Platform Openness, Digital Trust, Data Literacy and Digital Infrastructure

Ethnographic teams

As should be evident from the changes in how we work and where we should focus, there is equally a shift in who we should be working with on our teams. Designers continue to play a key role in making results actionable. However, there are other key new partners in the ethnographic team. Big data analysts play a key role in helping to capture the complexity of both the market environment and the patterns of cultural flux. In our example above, the scouring of the web to help understand the transformation and emergence of a data economy ecosystem relied on big data analytics. The partnership between big data and ethnography was essential in each being able to properly deliver results. In terms of ethnography, papers like anderson et al. (2009) and Patel (2010) have shown that big data can be a partner in the ethnographic enterprise, especially in a longitudinal approach and discovering patterns of cultural flux. Closely related to the analyst, is the data visualization expert. The visualization of the data has a key role both among researchers, as well as, representing the data out to corporations. The dramatic visualization of the unfolding of the ten year story of the data economy market was a compelling. It created a powerful visual story. This is more than “information architect” – it’s creating various forms of meaning by understanding data otherwise not understood – visualization creates the understanding as well as describes the data. Finally, bringing business analysts, e.g., economists, directly into the process become critical in enabling an organization to take understand and take action in the market. It is a good sign that many ethnographic firms that have presented at EPIC already have business analysts on staff. In the examples we have presented here, a business analyst has been integral to all of the research. In particular, business analysts are key in enabling a space for an organization or company to create order, as well as, creating and experimenting around catalysts.

FUTURE IS SO BRIGHT FOR ETHNOGRAPHY IN INDUSTRY

Ethnographic work in industry has and continues to improve its methods and techniques. There is, however, mounting evidence that the foundational value of the work related to innovation and new product development is shifting as the market environment shifts. In a system with the characteristics of high velocity market (Vm) and a more complex market system (Cs), ethnography in corporate context needs to make adjustments to how we add and create value through our organizations, as measured by (Vo). The shift to Vm-Cs environment is relatively new. The exact roles and methods that ethnography in industry may take on are still unclear. We have suggested some new directions, including a focus on Flux, Order and Catalysts (FOC). It is, however, clear that knowing people’s beliefs, values and practices in a context, and being to articulate their point of view, in order to reduce the uncertainty for new product development will no longer be sufficient for ethnography to retain critical value in business. The new market environment of Vm-Cs emerging, perhaps, creates an even greater opportunity space for ethnography, as it is able to enhance business success to embrace complexity, analyze change factors, and design and experiment to enable innovative agility. Our attention to this shift now will help to keep ethnographic praxis vital.

ken anderson is an anthropologist and Principle Engineer at Intel Corporation whose research explores areas of cultural-technological flux. Ken’s over 25 years of publications on research about culture and technology have appeared in computer, anthropology and business venues.

Tony Salvador, Senior Principal Engineer, currently directs research in the Experience Insights Lab within Intel Corporation. His team’s role is to identify new, strategic opportunities for technology based on an understanding of fluctuating, global socio-cultural values.

Brandon Barnett is Director of Business Innovation for Intel Corporation. An “experimental innovationologist”, he advances the science of innovation of firms, markets, and emerging ecosystems in the current climate of social, cultural, and technical change.

REFERENCES CITED

anderson, ken, Tye Rattenbury and Dawn Nafus

2009 “Numbers Have Qualities Too: Experiences with Ethno-mining.” In Proceedings of EPIC 2009.

Basole, Rahul C., Hyunwoo Park and Brandon Barnett

Forthcoming “Coopetition and Convergence in Mobile Ecosystems.” In “ICT as a complex and evolving system: Innovative approaches, metrics, and techniques for management and regulation.” Special issue,Telecommunications Policy.

Basole, Rahul C., Martha G. Russell, Jukka Huhtamaki, and Neil Rubens

2012 “Understanding Mobile Ecosystem Dynamics: A Data-Driven Approach.” Paper presented at International Conference on Mobile Business (ICMB), 2012.

Bezaitis, Maria and ken anderson

2011 “Flux: Changing Social Values and their Value for Business.” In Proceedings of EPIC 2011.

Bleeker, Julian

2009 “Design Fiction: A Short Essay on Design, Science, Fact and Fiction” Near Future Laboratory. Accessed June 10, 2013. http://drbfw5wfjlxon.cloudfront.net/writing/DesignFiction_WebEdition.pdf.

boyd, danah

Forthcoming “Making Sense of Teen Life: Strategies for Capturing Ethnographic Data in a Networked Era.” In Digital Research Confidential: The Secrets of Studying Behavior Online. E. Hargittai and C. Sandvig, eds. Cambridge, MA: MIT Press.

Cefkin, Melissa

2010 “Practice at the Crossroads: When Practice meets Theory.” In Proceedings of EPIC 2010.

Cefkin, Melissa, ed.

2010 Ethnography and the Corporate Encounter: Reflections on Research in and of Corporations. New York: Berghahn Books.

Churchill, Elizabeth and Elizabeth Goodman

2008 “Invisible Partners: People, Algorithms and Business Models in On-line Dating,” In Proceedings of EPIC 2008.

Crabtree, Andy, Mark Rouncefeld, and Peter Tolmie

2012 Doing Design Ethnography. New York: Springer Publications.

Galloway, Anne, Ben J. Kraal, & Jo A. Tacchi, eds.

2011 Ethnographic Fiction and Speculative Design Workshop. Association for Computing Machinery (ACM); State Library of Queensland, Brisbane, QLD.

Geertz, Clifford

1973 “Thick Description: Toward an Interpretive Theory of Culture.” In Interpretation of Culture. New York: Basic Books.

Gray, Mary

2012 “Anthropology as Big Data: Making the Case for Ethnography.” Paper presented at American Anthropological Association Meetings, November.

Grove, Andrew S.

1999 Only the Paranoid Survive: How to Exploit the Crisis Points that Challenge Every Company. New York: Crown Business.

Horst, Heather and Danny Miller, eds.

2011 Digital Anthropology. New York: Berg Publishers.

Ichikawa, Fumiko and Hiroshi Tamura

2012 “Maru: An Ethnographic Approach to Revive Local Communities.” In Proceedings EPIC 2012.

Jordan, Brigitta, ed.

2012 Advancing Ethnography in Corporate Environments: Challenges and Emerging Opportunities. San Francisco: Left Coast Press.

Nafus, Dawn and ken anderson

2006 “The Real Problem: Rhetorics of Knowing in Corporate Ethnographic Research.” In Proceedings of EPIC 2006.

Nafus, Dawn and Jamie Sherman

2013 “This One Does Not Go Up To Eleven: The Quantified Self Movement as an Alternative Big Data Practice.” In “Special issue on Big Data,” eds.Kate Crawford and Mary Gray, International Journal of Communication.

Patel, Neal

2011 “ ‘For A Ruthless Criticism of Everything Existing’: Rebellion Against the Quantitative/Qualitative Divide.” In Proceedings of EPIC 2011.

Porter, Michael E.

1998 Competitive Strategy: Techniques for Analyzing Industries and Competitors. Free Press.

Radka, Rich and Abby Margolis

2011 “Changing Models of Ownership.” In Proceedings of EPIC 2011.

Ries, Eric

2011 The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses. New York: Crown Business.

Snowden, David and Mary E. Boone

2007 “A Leader’s Framework for Decision Making.” Harvard Business Review, November 2007: 69–76.

Snowden, David

2005 “Multi-ontology Sense Making – A New Simplicity in Decision Making.” Informatics in Primary Health Care 13 (1): 45–53.

Salvador, Tony, Genevieve Bell and ken anderson

1999 “Design Ethnography.” Design Management Journal 10 (4): 35–41.

Wasson, Christina

2000 “Ethnography in the Field of Design.” Human Organization 59 (4): 377-388.